Foot Locker 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

Foreign Currency Translation

The functional currency of the Company’s international operations is the applicable local currency. The translation

of the applicable foreign currency into U.S. dollars is performed for balance sheet accounts using current exchange

rates in effect at the balance sheet date and for revenue and expense accounts using the weighted-average rates of

exchange prevailing during the year. The unearned gains and losses resulting from such translation are included as a

separate component of accumulated other comprehensive loss within shareholders’ equity.

Reclassifications

Certain balances in prior years have been reclassified to conform to the presentation adopted in the current

year.

Recent Accounting Pronouncements Not Previously Discussed Herein

In March 2006, the EITF reached a consensus on EITF Issue No. 06-3, “How Taxes Collected from Customers

and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That is, Gross versus Net

Presentation)” that entities may adopt a policy of presenting taxes in the income statement on either a gross or net

basis. Gross or net presentation may be elected for each different type of tax, but similar taxes should be presented

consistently. Taxes within the scope of this EITF would include taxes that are imposed on a revenue transaction between

a seller and a customer, for example, sales taxes, use taxes, value-added taxes, and some types of excise taxes. EITF 06-3

will not impact the method for recording these sales taxes in the Company’s consolidated financial statements as the

Company has historically presented sales excluding all taxes.

In July 2006, the FASB issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes - An interpretation

of FASB Statement No. 109” (“FIN 48”), which clarifies the accounting and disclosure requirements for uncertainty

in tax positions. This Interpretation requires financial statement recognition of the impact of a tax position if that

position is more likely than not of being sustained on audit based on the technical merits of the position. Additionally,

FIN 48 provides guidance on measurement, derecognition, classification, accounting in interim periods, and disclosure

requirements for uncertain tax positions. The provisions of FIN 48 will be effective as of the beginning of 2007, with

the cumulative effect of the change in accounting principle, if any, recorded as an adjustment to opening retained

earnings. The Company is currently evaluating the effect of FIN 48. However, the Company does not expect the adoption

of this interpretation will significantly affect the Company’s financial position or results of operations.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” (“SFAS No. 157”). This statement

provides a single definition of fair value, a framework for measuring fair value, and expanded disclosures concerning

fair value. Previously, different definitions of fair value were contained in various accounting pronouncements creating

inconsistencies in measurement and disclosures. SFAS No. 157 applies under those previously issued pronouncements

that prescribe fair value as the relevant measure of value, except SFAS No. 123(R) and related interpretations and

pronouncements that require or permit measurement similar to fair value but are not intended to measure fair value.

This pronouncement is effective for fiscal years beginning after November 15, 2007. The Company does not believe that

this standard will significantly affect the Company’s financial position or results of operations.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities—Including an Amendment of FASB Statement No. 115.” This statement permits, but does not require,

entities to measure many financial instruments at fair value. The objective is to provide entities with an opportunity to

mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to

apply complex hedge accounting provisions. The Company does not believe that this standard will significantly affect

the Company’s financial position or results of operations.

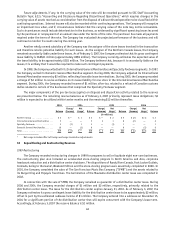

2 Staff Accounting Bulletin No. 108

In September 2006, the SEC issued Staff Accounting Bulletin No. 108 (“SAB 108”) “Considering the Effects of

Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” that provides

interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered

in quantifying a current year misstatement. There are two widely recognized methods for quantifying the effects

of financial statement misstatements: the “rollover” or income statement method and the “iron curtain” or balance

sheet method. The SEC staff believes that registrants should quantify errors using both a balance sheet and an income