Foot Locker 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TO OUR SHAREHOLDERS

Although faced with several external

challenges in our industry, especially

in Europe, our Company neverthe-

less generated solid fi nancial results

in 2006.

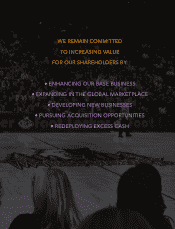

From a strategic standpoint, the

year was noteworthy because we

identifi ed new areas for growth and

took meaningful steps to capitalize

on those opportunities. As a result,

we enter 2007 invigorated with the

belief that our business is well-po-

sitioned to succeed in the global

marketplace. Our goal is to continue

to build on our leadership position

as the largest athletic footwear and

apparel retailer in the world.

Our management team is result-

oriented, self-driven and focused on

producing high returns. At the same

time, we are realistic in our expecta-

tions, which, given the competitive

nature of our industry, leads us to be

prudent in our decision making. We

understand that it may not be pos-

sible for our Company to achieve

its stretch fi nancial goals every year;

however, we continually strive to win

each and every contest in which we

participate and to overachieve when-

ever possible.

2006 Financial Standings

The following are the fi nancial high-

lights of 2006:

• Total sales increased to $5.75

billion

• Sales per gross square foot in-

creased to $365

• Net income per share, before a

non-cash impairment charge pur-

suant to SFAS No. 144, was $1.68

• Cash position, net of debt, was

$236 million

• Book value per share increased to

$14.74

We did not meet all of the goals

we set for ourselves going into the

year and, for the fi rst time this de-

cade, our income from continuing

operations did not increase from the

prior year. Nevertheless, we did post

respectable numbers for the year,

given the challenges we faced. Our

net income includes a $17 million

pre-tax, non-cash impairment charge

recorded during the second quarter

to write-down store long-lived assets

at the Company’s European opera-

tions pursuant to SFAS No. 144. The

Company’s pre-tax earnings from

continuing operations, excluding this

impairment charge, increased by $4

million as compared with the prior

year.

Two of our most important fi nan-

cial accomplishments in 2006 were

reducing the amount of debt on our

balance sheet and ending the year

with our qualifi ed pension plans

fully-funded on a GAAP basis. We

believe that our current fi nancial posi-

tion effectively supports our existing

business and that additional debt

capacity would be available should

we identify new investment opportu-

nities.

We use a team approach to man-

age our diversifi ed group of busi-

nesses, which means that when one

division has an “off-year,” another

division must step up to the plate and

pick up the slack. This was the case

in 2006, as it has been in previous

years. We believe this structure en-

hances our ability to produce consis-

tent fi nancial results in the future.

At Foot Locker, Inc., the goal is to continue to build

on our leadership position as the largest athletic

footwear and apparel retailer in the world.

2