Foot Locker 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

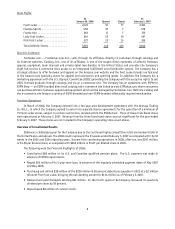

16

2006 2005

(in millions)

Cash, cash equivalents and short-term investments, net of debt and

capital lease obligations .................................. $ 236 $ 261

Present value of operating leases .............................. 2,069 1,934

Total net debt........................................... 1,833 1,673

Shareholders’ equity ........................................ 2,295 2,027

Total capitalization ......................................... $4,128 $3,700

Net debt capitalization percent................................ 44.4% 45.2%

Net debt capitalization percent without operating leases ............ —% —%

Excluding the present value of operating leases, the Company’s cash, cash equivalents, and short-term investments,

net of debt and capital lease obligations, decreased to $236 million at February 3, 2007 from $261 million at January

28, 2006. The Company reduced debt and capital lease obligations by $92 million, and decreased cash, cash equivalents,

and short-term investments by $117 million. Additionally, the present value of the operating leases increased by $135

million representing the net change of lease renewals and the effect of foreign currency fluctuations primarily related

to the euro. Including the present value of operating leases, the Company’s net debt capitalization percent decreased

80 basis points in 2006. The increase in shareholders’ equity relates to net income of $251 million in 2006, $17 million

related to stock plans, an increase of $27 million in the foreign exchange currency translation adjustment, primarily

related to the value of the euro in relation to the U.S. dollar and a decrease of $6 million resulting from the adoption

of SAB 108. The Company recorded a reduction to shareholders’ equity as permitted by SAB 108 to correct for previous

misstatements. The Company declared and paid dividends totaling $61 million during 2006. The Company repurchased

334,200 million shares for approximately $8 million during the year. During 2006, the Company adopted SFAS No. 158

which resulted in the elimination of the additional minimum liability adjustment of $181 million. SFAS No.158 requires

that unamortized prior service cost and unamortized gains or losses for both the pension and postretirement plans,

which totaled $133 million, be recognized as a component of other comprehensive income. The Company contributed

$51 million and $17 million to the Company’s U.S. and Canadian qualified pension plans, respectively, in 2006.

Excluding the present value of operating leases, the Company’s cash, cash equivalents and short-term investments,

net of debt and capital lease obligations, increased to $261 million at January 28, 2006 from $127 million at January 29,

2005. The Company reduced debt and capital lease obligations by $39 million, while increasing cash, cash equivalents

and short-term investments by $95 million. Additionally, the present value of the operating leases decreased by $55

million representing the net change of lease renewals, the effect of foreign currency fluctuations primarily related

to the euro and the result of the closure of 25 stores due to the hurricanes. Including the present value of operating

leases, the Company’s net debt capitalization percent decreased 520 basis points in 2005. The increase in shareholders’

equity relates to net income of $264 million in 2005, $26 million related to stock plans, and a decrease of $25 million

in the foreign exchange currency translation adjustment, primarily related to the value of the euro in relation to

the U.S. dollar. The Company declared and paid dividends totaling $49 million during 2005.The Company repurchased

approximately 1.6 million shares for $35 million during the year. During 2005, the Company reduced its minimum liability

for the Company’s pension plans by $15 million, primarily as a result of the plans’ asset performance. The Company

contributed $19 million and $7 million to the Company’s U.S. and Canadian qualified pension plans, respectively, in

2005.