Foot Locker 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

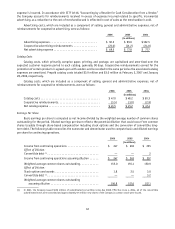

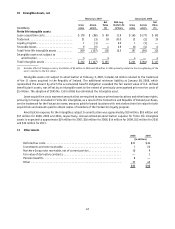

Options to purchase 2.8 million, 2.2 million and 1.5 million shares of common stock as of February 3, 2007, January

28, 2006, and January 29, 2005, respectively, were not included in the computations because the exercise price of the

options was greater than the average market price of the common shares and, therefore, the effect of their inclusion

would be antidilutive.

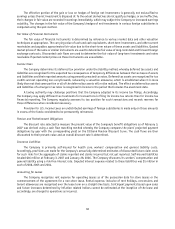

Share-Based Compensation

Effective January 29, 2006, the Company adopted the provisions of Statement of Financial Accounting Standards

No. 123(R), “Share-Based Payment,” and related interpretations, (“SFAS No. 123(R)”) to account for stock-based

compensation using the modified prospective transition method and, therefore, will not restate its prior period results.

SFAS No. 123(R) supersedes Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees,”

(“APB No. 25”), and revises guidance in SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS No. 123”).

Among other things, SFAS No. 123(R) requires that compensation expense be recognized in the financial statements

for share-based awards based on the grant date fair value of those awards. The modified prospective transition method

applies to unvested stock options, restricted shares and stock appreciation rights and issuances under the employee

stock purchase plan outstanding as of January 29, 2006 based on the grant-date fair value estimated in accordance

with the pro forma provisions of SFAS No. 123, and any new share-based awards granted subsequent to January 29, 2006,

based on the grant-date fair value estimated in accordance with the provisions of SFAS No. 123(R). Additionally, stock-

based compensation expense includes an estimate for pre-vesting forfeitures and is recognized over the requisite

service periods of the awards over the vesting term.

Prior to January 29, 2006, the Company accounted for these stock-based compensation plans in accordance with

APB No. 25 and related interpretations. This method did not result in compensation cost for stock options and shares

purchased under employee stock purchase plans. No compensation expense for employee stock options was recorded,

as all stock options granted under the stock option plans had an exercise price that was not less than the quoted

market price at the date of grant. Compensation expense was also not recorded for employee purchases of stock under

the employee stock purchase plans as it was considered non-compensatory under APB No. 25. Prior to the Company’s

adoption of SFAS No. 123(R), as required under the disclosure provisions of SFAS No. 123, as amended, the Company

provided pro forma net income and earnings per common share for each period as if it had applied the fair value method

to measure stock-based compensation expense.

The Company has recorded an additional $6 million of stock-based compensation expense, net of estimated

forfeitures, during 2006 as a result of its adoption of SFAS No. 123(R). During 2006, the Company recorded a cumulative

effect of a change in accounting of $1 million to reflect estimated forfeitures for prior periods related to the Company’s

nonvested restricted stock awards. Prior to the adoption of SFAS No. 123(R), the Company recognized compensation cost

of restricted stock awards over the vesting term based upon the fair value of the Company’s common stock at the date of

grant. Forfeitures were recorded as they occurred, however under SFAS No. 123(R) an estimate of forfeitures is required

to be included over the vesting term. Under SFAS No. 123(R), the Company will continue to recognize compensation

expense over the vesting term, net of estimated forfeitures. See Note 22 for information on the assumptions the

Company used to calculate the fair value of stock-based compensation.

SFAS No. 123(R) requires the benefits associated with tax deductions in excess of recognized compensation cost

to be reported as a financing cash flow rather than as an operating cash flow as previously required. For 2006, the

Company recorded an excess tax benefit of $2 million as a financing cash flow as required by the standard.

Upon exercise of stock options, issuance of restricted stock or issuance of shares under the employee stock

purchase plan, the Company will issue authorized but unissued common stock or use common stock held in treasury.

The Company may make repurchases of its common stock from time to time, subject to legal and contractual restrictions,

market conditions and other factors.