Foot Locker 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

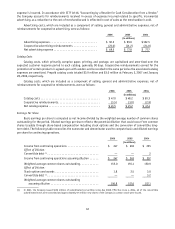

40

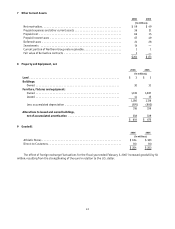

Long-Lived Assets

2006 2005 2004

(in millions)

United States ........................................... $504 $523 $547

International ........................................... 150 152 168

Total long-lived assets .................................... $654 $675 $715

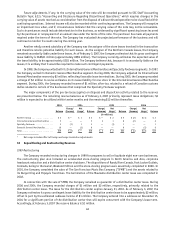

4 Other Income

In 2006, other income includes a gain of $8 million related to a final settlement with the Company’s insurance

carriers of claims related to Hurricane Katrina. In 2005, the Company recorded a gain of $3 million of insurance

recoveries in excess of losses associated with Hurricane Katrina.

During 2006, the Company purchased and retired $38 million of the $200 million 8.50 percent debentures payable

in 2022, at a $2 million discount from face value. Also during 2006, the Company terminated two of its leases and

recorded a net gain of $4 million.

In 2005, the Company recorded a net gain of $3 million related to foreign currency option contracts that were

entered into by the Company to mitigate the effect of fluctuating foreign exchange rates on the reporting of euro

denominated earnings.

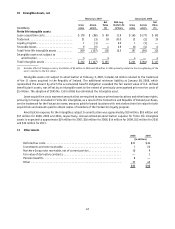

5 Short-Term Investments

The Company’s auction rate security investments are accounted for as available-for-sale securities. The fair value

of all investments approximate their carrying cost as the investments are generally not held for more than 49 days and

they are traded at par value. The following represents the composition of the Company’s auction rate securities by

underlying investment.

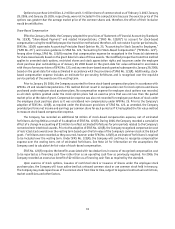

2006 2005

(in millions)

Tax exempt municipal bonds ........................................ $ 44 $ 41

Equity securities ................................................. 205 257

$249 $298

Contractual maturities of the bonds outstanding at February 3, 2007 range from 2026 to 2042.

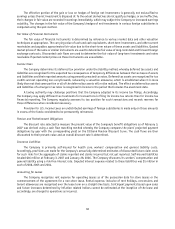

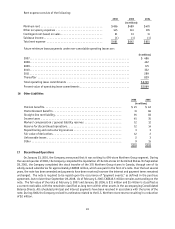

6 Merchandise Inventories

2006 2005

(in millions)

LIFO inventories ............................................... $ 967 $ 939

FIFO inventories ............................................... 336 315

Total merchandise inventories .................................... $1,303 $1,254

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as calculated

on a FIFO basis.