Foot Locker 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

The Company has designated these hedging instruments as hedges of the net investments in foreign subsidiaries,

and will use the spot rate method of accounting to value changes of the hedging instrument attributable to currency

rate fluctuations. As such, adjustments in the fair market value of the hedging instrument due to changes in the spot

rate will be recorded in other comprehensive income and are expected to offset changes in the euro-denominated net

investment. Amounts recorded to foreign currency translation within accumulated other comprehensive loss will remain

there until the net investment is disposed of. The amount recorded within the foreign currency translation adjustment

included in accumulated other comprehensive loss on the Consolidated Balance Sheet at February 3, 2007 decreased

shareholders’ equity by $5 million, net of tax. At January 28, 2006, the amount recorded to foreign currency translation

was not significant. The effect on the Consolidated Statements of Operations related to the net investments hedges

was income of $3 million for 2006 and was not significant for 2005.

Foreign Exchange Risk Management — Derivative Holdings Designated as Non-Hedges

The Company mitigates the effect of fluctuating foreign exchange rates on the reporting of foreign currency

denominated earnings by entering into a variety of derivative instruments including option currency contracts. These

contracts are not designated as hedges and as a result, the changes in the fair value of these financial instruments are

charged to the statement of operations immediately. The changes in fair values recorded in the Consolidated Statement

of Operations for the year ended February 3, 2007 was not significant and was a net gain of approximately $3 million for

contracts that settled in the second quarter of 2005.

The Company also enters into certain forward foreign exchange contracts to hedge intercompany foreign-currency

denominated transactions. In 2005, the Company recorded gains of approximately $3 million in selling, general and

administrative expenses to reflect the fair value of these contracts. These gains were offset by the foreign exchange

losses on the revaluation of the underlying assets or liabilities. The amount recorded during 2006 was not significant.

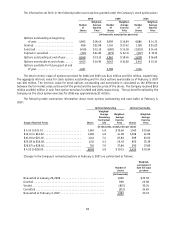

Foreign Currency Exchange Rates

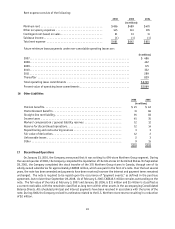

The table below presents the fair value, notional amounts, and weighted-average exchange rates of foreign

exchange forward and option contracts outstanding at February 3, 2007.

Fair Value

(US in millions)

Contract Value

(US in millions)

Weighted-Average

Exchange Rate

Inventory

%W[a6GNN%TKVKUJ ............................. $ (1) $63 .6799

%W[866GNNa ................................ — 4 1.3108

Buy $US/Sell CAD$ ............................. — 2 .9088

Earnings

6GNNa%W[86 ................................ $— $29 1.2962

Sell CAD$/ Buy $US ............................. — 7 .8739

Intercompany

%W[a6GNN%TKVKUJ ............................ $— $25 .6762

%W[%TKVKUJ6GNNa ............................. — 25 .6668

%W[6(.6GNNa ................................ — 1 .7456

%W[a6GNN86 ................................ — 1 1.3078

Buy US/Sell NZD ............................... — 2 .5985

Buy US/Sell AUD ............................... — 2 .7456

Buy US/Sell CAD ............................... — 1 .8727