Foot Locker 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

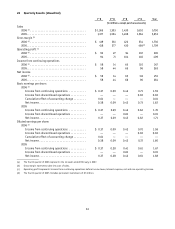

Pension Benefits

Postretirement

Benefits

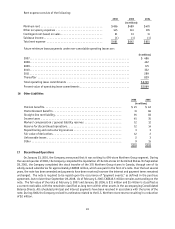

2006 2005 2006 2005

(in millions)

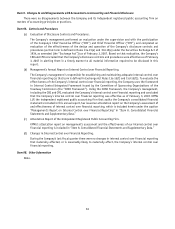

Change in plan assets

Fair value of plan assets at beginning of year . . . $ 579 $ 551

Actual return on plan assets ................ 60 60

Employer contribution .................... 70 29

Foreign currency translation adjustments ...... (2) 5

Benefits paid ........................... (60) (66)

Fair value of plan assets at end of year ........ $647 $579

Funded status

Funded status........................... $ (15) $(110) $(13) $(17)

Unrecognized prior service cost (benefit) ...... 3 (9)

Unrecognized net (gain) loss ............... 303 (60)

Prepaid asset (accrued liability) ............. $196 $(86)

Balance Sheet caption reported in:

Intangible assets ........................ $ — $ 1 $— $ —

Other assets ............................ 8 — — —

Accrued and other liabilities ............... (2) (70) (2) (2)

Other liabilities ......................... (21) (42) (11) (84)

Accumulated other comprehensive loss, pre-tax. . — 307 — —

$ (15) $ 196 $(13) $(86)

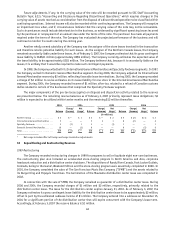

At February 3, 2007, the aggregate amount of accumulated benefit obligations which exceed plan assets totaled

$23 million representing the Company’s nonqualified pension plans. The Company’s qualified pension plans were fully

funded at February 3, 2007. At January 28, 2006, the accumulated benefit obligations of $688 million exceeded plan

assets of $579 million for all pension plans.

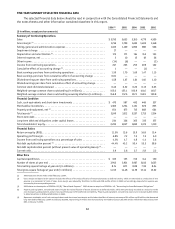

Amounts recognized in accumulated other comprehensive loss (pre-tax) at February 3, 2007 consists of:

Pension

Benefits

Postretirement

Benefits

Prior service cost (benefit) ................... $ 4 $ (7)

Net actuarial (gain)loss ..................... 274 (53)

Total amount recognized ..................... $278 $ (60)

The following represents the change to the Consolidated Balance Sheet as of February 3, 2007 as a result of the

adoption of SFAS No. 158:

Prior to

AML and

Statement

No. 158

Adju stm ent s

AML

Adjustment

Effect of

Adoption

Statement

No. 158

Post AML and

Statement

No. 158

Adjustments

(in millions)

Current assets ................................... 2,034 — — 2,034

Deferred taxes ................................... 144 (120) 85 109

Intangible assets ................................. 106 (1) — 105

Other assets ..................................... 75 — 8 83

Total assets ..................................... $3,277 (121) 93 $3,249