Foot Locker 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

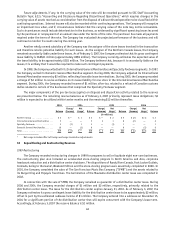

39

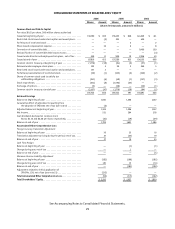

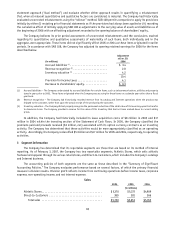

Operating Results

2006 2005 2004

(in millions)

Athletic Stores ....................................... $405 $ 419 $420

Direct-to-Customers ................................... 45 48 45

450 467 465

Restructuring charges (1) ................................ (1) — (2)

Division profit ....................................... 449 467 463

Corporate expense (2) ................................... (68) (58) (74)

Operating profit ...................................... 381 409 389

Other income (3) ....................................... 14 6 —

Interest expense, net .................................. 3 10 15

Income from continuing operations before income taxes ....... $392 $405 $ 374

(1) The restructuring charge in 2006 represents a revision to the original estimate of the lease liability associated with the guarantee of

The San Francisco Music Box distribution center. During 2004, the Company recorded a restructuring charge of $2 million related to the

dispositions of non-core businesses. These charges were classified within selling, general and administrative expenses in the Consolidated

Statements of Operations.

(2) 2004 includes integration costs of $5 million related to the acquisitions of Footaction and the 11 stores in the Republic of Ireland.

(3) 2006 includes $4 million gain on lease terminations; $8 million of insurance proceeds related to the 2005 hurricane; and $2 million gain on

debt repurchase.

2005 includes a $3 million gain from insurance recoveries associated with Hurricane Katrina. Additionally, $3 million represents a net gain

on foreign currency option contracts that were entered into by the Company to mitigate the effect of fluctuating foreign exchange rates on

the reporting of euro dominated earnings.

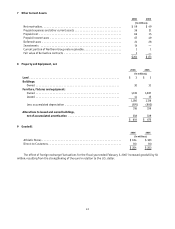

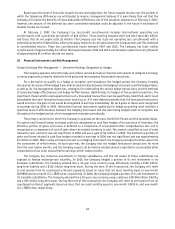

Depreciation and

Amortization Capital Expenditures Total Assets

2006 2005 2004 2006 2005 2004 2006 2005 2004

(in millions)

Athletic Stores .............. $147 $141 $126 $135 $137 $139 $2,374 $2,322 $2,335

Direct-to-Customers .......... 66546 8195196190

153 147 131 139 143 147 2,569 2,518 2,525

Corporate .................. 22 24 23 26 12 9 680 794 711

Discontinued operations ....... ————— — — — 1

Total Company .............. $175 $171 $154 $165 $155 $156 $3,249 $3,312 $3,237

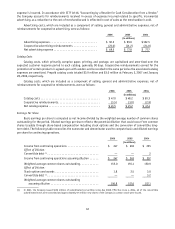

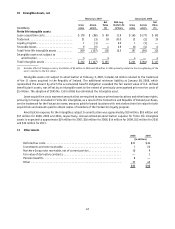

Sales and long-lived asset information by geographic area as of and for the fiscal years ended February 3, 2007,

January 28, 2006 and January 29, 2005 are presented below. Sales are attributed to the country in which the sales

originate, which is where the legal subsidiary is domiciled. Long-lived assets reflect property and equipment. The

Company’s sales in Italy and France represent approximately 36, 39 and 40 percent of the International category’s sales

for the three-year period ended February 3, 2007. No other individual country included in the International category

is significant.

Sales

2006 2005 2004

(in millions)

United States ....................................... $4,356 $4,257 $3,982

International ....................................... 1,394 1,396 1,373

Total sales ......................................... $5,750 $5,653 $5,355