Foot Locker 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

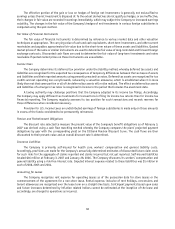

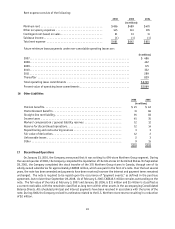

Rent expense consists of the following:

2006 2005 2004

(in millions)

Minimumrent ........................................ $496 $489 $470

Other occupancy expenses .............................. 145 141 135

Contingent rent based on sales ........................... 21 13 11

Sublease income ...................................... (1) (1) (1)

Total rent expense .................................... $661 $642 $615

Future minimum lease payments under non-cancelable operating leases are:

(in millions)

2007 ................................................................ $ 486

2008 ................................................................ 432

2009 ................................................................ 371

2010 ................................................................ 332

2011 ................................................................ 289

Thereafter ........................................................... 829

Total operating lease commitments ........................................ $2,739

Present value of operating lease commitments ................................ $2,069

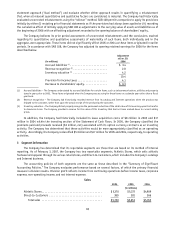

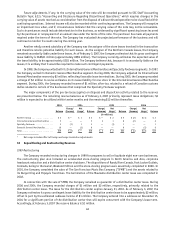

16 Other Liabilities

2006 2005

(in millions)

Pension benefits .................................................. $ 21 $ 42

Postretirement benefits ............................................ 11 84

Straight-line rent liability ........................................... 91 83

Income taxes .................................................... 45 35

Workers’ compensation / general liability reserves ........................ 12 12

Reserve for discontinued operations ................................... 12 14

Repositioning and restructuring reserves ............................... 3 3

Fair value of derivatives ............................................ 12 2

Unfavorable leases ................................................ 2 3

Other .......................................................... 9 15

$218 $293

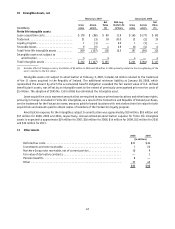

17 Discontinued Operations

On January 23, 2001, the Company announced that it was exiting its 694-store Northern Group segment. During

the second quarter of 2001, the Company completed the liquidation of the 324 stores in the United States. On September

28, 2001, the Company completed the stock transfer of the 370 Northern Group stores in Canada, through one of its

wholly owned subsidiaries for approximately CAD$59 million, which was paid in the form of a note. Over the last several

years, the note has been amended and payments have been received, however the interest and payment terms remained

unchanged. The note is required to be repaid upon the occurrence of “payment events,” as defined in the purchase

agreement, but no later than September 28, 2008. As of February 3, 2007, CAD$15.5 million remains outstanding on the

note. The fair value of the note at February 3, 2007 and January 28, 2006, is $11 million and $1 million is classified as

a current receivable, with the remainder classified as long term within other assets in the accompanying Consolidated

Balance Sheets. All scheduled principal and interest payments have been received in accordance with the terms of the

note. During 2006, the Company revised its estimates related to the U.S. Northern store reserve resulting in a reduction

of $2 million.