Foot Locker 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

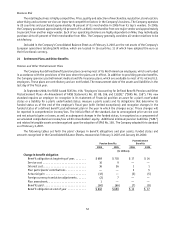

Beginning with 2001, new retirees were charged the expected full cost of the medical plan and existing retirees

will incur 100 percent of the expected future increase in medical plan costs. Any changes in the health care cost trend

rates assumed would not affect the accumulated benefit obligation or net benefit income, since retirees will incur 100

percent of such expected future increases.

In December 2003, the United States enacted into law the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (the “Act”). The Act establishes a prescription drug benefit under Medicare, known as

“Medicare Part D,” and a Federal subsidy to sponsors of retiree health care benefit plans that provide a benefit that

is at least actuarially equivalent to Medicare Part D. The Company has determined that it will qualify for the subsidy,

however the effect of the subsidy was not significant to either the benefit obligation or net benefit income.

In August 2006, the Pension Protection Act of 2006 was signed into law. The major provisions of the statute will

take effect January 1, 2008. Among other things, the statute is designed to ensure timely and adequate funding of

pension plans by shortening the time period within which employers must fully fund pension benefits. The Company is

currently evaluating the effect, if any, that the Pension Protection Act of 2006 will have on funding requirements. The

effect on net periodic benefit cost is not expected to be significant.

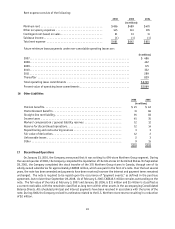

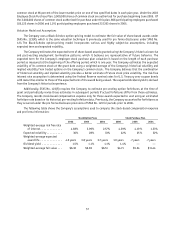

The Company’s pension plan weighted-average asset allocations at February 3, 2007 and January 28, 2006, by

asset category are as follows:

2006 2005

Asset Category

Equity securities ........................................... 64% 62%

Foot Locker, Inc. common stock ............................... 1% 2%

Debt securities ............................................ 33% 34%

Real estate ............................................... 1% 1%

Other ................................................... 1% 1%

Total ................................................... 100% 100%

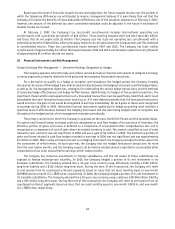

The U.S. defined benefit plan held 396,000 shares of Foot Locker, Inc. common stock as of February 3, 2007 and

January 28, 2006. Currently, the target composition of the weighted-average plan assets is 64 percent equity and 36

percent fixed income securities, although the Company may alter the targets from time to time depending on market

conditions and the funding requirements of the pension plans. The Company believes that plan assets are invested

in a prudent manner with an objective of providing a total return that, over the long term, provides sufficient assets

to fund benefit obligations, taking into account the Company’s expected contributions and the level of risk deemed

appropriate. The Company’s investment strategy is to utilize asset classes with differing rates of return, volatility and

correlation to reduce risk by providing diversification relative to equities. Diversification within asset classes is also

utilized to reduce the effect that the return of any single investment may have on the entire portfolio.

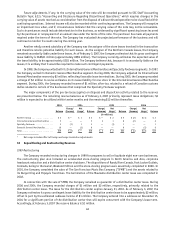

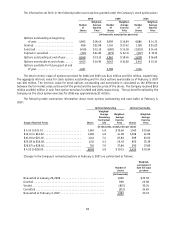

Estimated future benefit payments for each of the next five years and the five years thereafter are as follows:

Pension

Benefits

Postretirement

Benefits

(in millions)

2007 ............................................. $ 64 $2

2008 ............................................. 62 2

2009 ............................................. 61 2

2010 ............................................. 58 2

2011 ............................................. 56 1

2012–2015 ............................................. 259 5

In the fourth quarter of 2006, the Company and its U.S. pension plan, the Foot Locker Retirement Plan, were

named as defendants in a class action in federal court in Illinois. The Complaint alleged that the Company’s pension

plan violated the Employee Retirement Income Security Act of 1974 as a result of the Company’s conversion of its

defined benefit plan to a defined benefit pension plan with a cash balance feature in 1996. In March 2007, the class

action was dismissed without prejudice. In February 2007, the same plaintiff filed a class action in federal court in New

York against the Company and its U.S. pension plan, the Foot Locker Retirement Plan. The Complaint alleged that the