Foot Locker 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

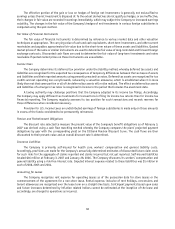

statement approach (“dual method”) and evaluate whether either approach results in quantifying a misstatement

that, when all relevant quantitative and qualitative factors are considered, is material. The Company had historically

evaluated uncorrected misstatements using the “rollover” method. SAB 108 permits companies to apply its provisions

initially by either (i) restating prior financial statements as if the provisions had always been applied or (ii) recording

the cumulative effect of initially applying SAB 108 as adjustments to the carrying value of assets and liabilities as of

the beginning of 2006 with an offsetting adjustment recorded to the opening balance of shareholders’ equity.

The Company believes its prior period assessments of uncorrected misstatements and the conclusions reached

regarding its quantitative and qualitative assessments of materiality of such items, both individually and in the

aggregate, were appropriate. These items did not significantly affect 2005 or 2004 as these items originated in earlier

periods. In accordance with SAB 108, the Company has adjusted its opening retained earnings for 2006 for the items

described below.

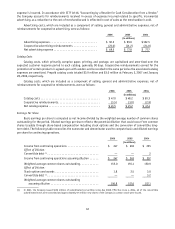

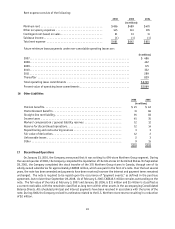

(in millions)

Adjustment

at Jan. 29,

2006

Accrued liabilities (1) ........................ $ 3.4

Revenue recognition (2) ...................... 2.8

Inventory valuation (3) ...................... 4.2

10.4

Provision for income taxes ................... 4.1

Decrease to shareholders’ equity ............... $ 6.3

(1) Accrued liabilities – The Company understated its accrued liabilities for certain items, such as telecommunications, utilities and property

taxes in years prior to 2003. These items originated when the Company was accruing for these items on a calendar year rather than a fiscal

year basis.

(2) Revenue recognition – The Company had historically recorded revenue from its catalog and Internet operations when the product was

shipped to the customer, rather than upon the actual receipt of the product by the customer.

(3) Inventory valuation – The Company did not properly recognize the permanent reduction of the retail value of its inventory upon the transfer

to clearance stores. The Company provided a reserve for the value of this inventory that had not been marked down to current selling

prices.

In addition, the Company had historically included its lease acquisition costs of $8 million in 2005 and $17

million in 2004 within the investing section of the Statement of Cash Flows. In 2005, the Company classified the

premiums paid and proceeds received ($3 million, net) associated with its option currency contracts as an investing

activity. The Company has determined that these activities would be more appropriately classified as an operating

activity. Accordingly, the Company reclassified $5 million and $17 million for 2005 and 2004, respectively, to operating

activities.

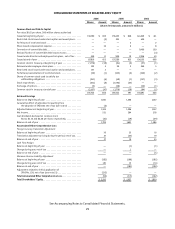

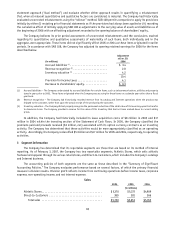

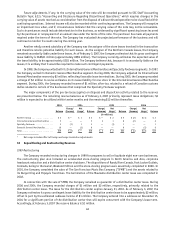

3 Segment Information

The Company has determined that its reportable segments are those that are based on its method of internal

reporting. As of February 3, 2007, the Company has two reportable segments, Athletic Stores, which sells athletic

footwear and apparel through its various retail stores, and Direct-to-Customers, which includes the Company’s catalogs

and Internet business.

The accounting policies of both segments are the same as those described in the “Summary of Significant

Accounting Policies.” The Company evaluates performance based on several factors, of which the primary financial

measure is division results. Division profit reflects income from continuing operations before income taxes, corporate

expense, non-operating income, and net interest expense.

Sales

2006 2005 2004

(in millions)

Athletic Stores....................................... $5,370 $5,272 $4,989

Direct-to-Customers .................................. 380 381 366

Total sales ....................................... $5,750 $5,653 $5,355