Foot Locker 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

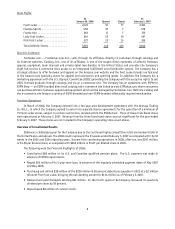

Contractual Obligations and Commitments

The following tables represent the scheduled maturities of the Company’s contractual cash obligations and other

commercial commitments as of February 3, 2007:

Payments Due by Period

Contractual Cash Obligations Total

Less than

1 Year

2 – 3

Years

3 – 5

Years

After 5

Years

(in millions)

Long-term debt (1) ......................... $ 220 $ — $ 90 $ — $130

Operating leases .......................... 2,739 486 803 621 829

Capital lease obligations .................... 14 14 — — —

Other long-term liabilities (2) ................. — — — — —

Total contractual cash obligations ............ $2,973 $500 $893 $621 $959

(1) The amounts presented above represent the contractual maturities of the Company’s long-term debt, excluding interest. Additional

information is included in the “Long-Term Debt and Obligations under Capital Leases” footnote under “Item 8. Consolidated Financial

Statements and Supplementary Data.”

(2) The Company’s other liabilities in the Consolidated Balance Sheet as of February 3, 2007 primarily comprise pension and postretirement

benefits, deferred rent liability, income taxes, workers’ compensation and general liability reserves and various other accruals. These

liabilities have been excluded from the above table as the timing and/or amount of any cash payment is uncertain. The timing of the

remaining amounts that are known have not been included as they are minimal and not useful to the presentation. Additional information

is included in the “Other Liabilities” footnote under “Item 8. Consolidated Financial Statements and Supplementary Data.”

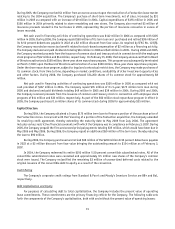

Total

Amounts

Committed

Amount of Commitment Expiration by Period

Other Commercial Commitments

Less than

1 Year

2 – 3

Years

3 – 5

Years

After 5

Years

(in millions)

Line of credit .......................... $ 186 $ — $186 $ — $—

Stand-by letters of credit ................. 14 — 14 — —

Purchase commitments (3) ................. 1,676 1,670 5 1 —

Other (4) .............................. 53 25 21 7 —

Total commercial commitments ............. $1,929 $1,695 $226 $ 8 $—

(3) Represents open purchase orders, as well as minimum required purchases under merchandise contractual agreements, at February 3, 2007.

The Company is obligated under the terms of purchase orders; however, the Company is generally able to renegotiate the timing and quantity

of these orders with certain vendors in response to shifts in consumer preferences.

(4) Represents payments required by non-merchandise purchase agreements and minimum royalty requirements.

The Company does not have any off-balance sheet financing, other than operating leases entered into in the normal

course of business as disclosed above, or unconsolidated special purpose entities. The Company does not participate

in transactions that generate relationships with unconsolidated entities or financial partnerships, including variable

interest entities. The Company’s policy prohibits the use of derivatives for which there is no underlying exposure.

In connection with the sale of various businesses and assets, the Company may be obligated for certain lease

commitments transferred to third parties and pursuant to certain normal representations, warranties, or indemnifications

entered into with the purchasers of such businesses or assets. Although the maximum potential amounts for such

obligations cannot be readily determined, management believes that the resolution of such contingencies will not

significantly affect the Company’s consolidated financial position, liquidity, or results of operations. The Company

is also operating certain stores for which lease agreements are in the process of being negotiated with landlords.

Although there is no contractual commitment to make these payments, it is likely that leases will be executed.

Critical Accounting Policies

Management’s responsibility for integrity and objectivity in the preparation and presentation of the Company’s

financial statements requires diligent application of appropriate accounting policies. Generally, the Company’s

accounting policies and methods are those specifically required by U.S. generally accepted accounting principles

(“GAAP”). Included in the “Summary of Significant Accounting Policies” footnote in “Item 8. Consolidated Financial