Foot Locker 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

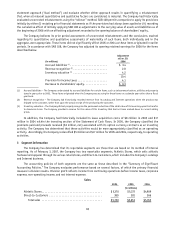

1993 Repositioning and 1991 Restructuring

The Company recorded charges in 1993 and in 1991 to reflect the anticipated costs to sell or close under-performing

specialty and general merchandise stores in the United States and Canada. As of February 3, 2007 the reserve balance

is $3 million.

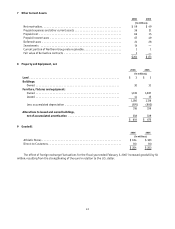

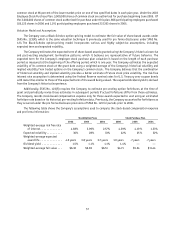

19 Income Taxes

Following are the domestic and international components of pre-tax income from continuing operations:

2006 2005 2004

(in millions)

Domestic .............................................. $320 $309 $222

International ........................................... 72 96 152

Total pre-tax income ...................................... $392 $405 $374

The income tax provision consists of the following:

2006 2005 2004

(in millions)

Current:

Federal ........................................... $ 93 $ 72 $ 11

State and local ..................................... 14 11 6

International ...................................... 17 35 52

Total current tax provision ............................ 124 118 69

Deferred:

Federal ........................................... 10 22 43

State and local ..................................... 6 7 8

International ...................................... 5 (5) (1)

Total deferred tax provision.............................. 21 24 50

Total income tax provision............................... $145 $142 $119

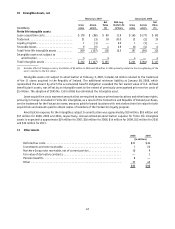

Provision has been made in the accompanying Consolidated Statements of Operations for additional income

taxes applicable to dividends received or expected to be received from international subsidiaries. The amount of

unremitted earnings of international subsidiaries for which no such tax is provided and which is considered to be

permanently reinvested in the subsidiaries totaled $426 million and $388 million at February 3, 2007, and January 28,

2006, respectively.

A reconciliation of the significant differences between the federal statutory income tax rate and the effective

income tax rate on pre-tax income from continuing operations is as follows:

2006 2005 2004

Federal statutory income tax rate ....................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal tax benefit ...... 3.3 2.8 2.3

International income taxed at varying rates ............... (0.9) 0.8 (0.6)

Foreign tax credit utilization .......................... (1.2) (3.1) (2.5)

Increase (decrease) in valuation allowance ................ 0.1 (1.5) 0.1

Federal/foreign tax settlements ........................ (0.1) 0.4 (3.3)

Tax exempt obligations ............................... (0.5) (0.4) (0.2)

Federal tax credits .................................. (0.2) (0.2) (0.2)

Other, net ......................................... 1.4 1.2 1.1

Effective income tax rate ............................. 36.9% 35.0% 31.7%