Experian 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

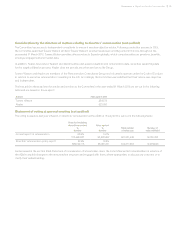

Element and

link to strategy Operation

Maximum potential value

and payment at target

Performance metrics,

weightings, relevant time

period and clawback

PSP

Use of stretching

financial metrics

incentivises

performance.

Aligns with shareholder

interests through delivery

of shares.

Annual award of conditional shares which vest

subject to achieving performance targets tested

over a three-year period.

Dividend equivalents accrue on conditional awards

of shares.

Normal maximum

award levels are 200%

of salary. Awards of up

to 400% of salary may

be made in exceptional

circumstances such as

on recruitment.

Minimum vesting of

awards is zero.

Nothing vests for below-

target performance.

For target performance,

25% of the shares vest.

For maximum

performance, 100%

of the shares vest.

Vesting of up to 25% of

the awards is based on a

share-based metric, with

the balance based on

financial performance.

Awards are also subject

to a financial underpin

whereby vesting is

subject to the Committee

being satisfied that it is

not based on materially

misstated financial results.

The Committee will

exercise its judgment

on whether to vary the

level of vesting, if it

considers that the level

of vesting determined by

measuring performance

is inconsistent with the

Group’s actual underlying

financial and operational

performance.

Clawback provisions apply.

Share Option Plan (‘SOP’)

Provides focus on

increasing Experian’s

share price over the

medium to longer term.

Options are granted with an exercise price equivalent

to the market value of an Experian share at the date

of grant. These vest subject to achieving performance

targets that are tested over a three-year period and

are exercisable for a seven-year period thereafter.

No option grants have been made since 2009 and

the Committee has agreed that no further awards

will be made, unless warranted by exceptional

circumstances such as recruitment.

Normal maximum

awards are 200% of

salary. However, the rules

of the SOP allow awards

of up to 400% of salary.

Minimum vesting of

awards is zero.

Nothing vests for below-

target performance.

For target performance,

25% of the options vest.

For maximum

performance, 100%

of the options vest.

The vesting of options

is based on financial

performance targets.

Clawback provisions apply.

97Governance •Report on directors’ remuneration