Experian 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

I am pleased to make my first Corporate

governance report to you as Chairman

of Experian, and to outline the key ways

in which we applied the UK Corporate

Governance Code principles regarding

the Board’s role and effectiveness during

the year.

In our Annual Report 2014, we described

important Board changes and the reasons

for them. Although they necessarily

involved transition, the changes have

gone smoothly and have energised and

enhanced the already strong Board team.

In addition, the Board’s commitment to

effective corporate governance, and to

ensuring that the Group operates openly

and transparently, remains firm.

Of course, no organisation can stand still

from a governance perspective, so we

review and develop our structures and

processes, both to meet the UK Corporate

Governance Code’s continuously evolving

best practice recommendations and

because it is the right thing to do for our

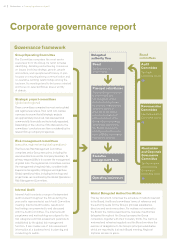

business. In this Corporate governance

report, we provide some insight into the

Group’s governance framework, the key

activities of the Board and its committees

during the year, how we have engaged with

investors (including the important role of

our Deputy Chairman, George Rose) and

the Group’s risk management and internal

controls systems. We also provide an

update on the tender of the exter nal audi t.

Board role

One of the Board’s key roles is to set the

Group’s strategic aims. The Board held its

annual strategy session in January 2015,

which was part of a detailed process that

included outlining our strategic priorities

to the market. These are to: focus on

our key strengths; deliver performance

improvements; seize attractive growth

opportunities; drive operational efficiency

and productivity; and rigorously optimise

capital. You will find more detail on our

five strategic priorities in the Our

strategy section.

We have also said that we must adapt to

changing market influences, including

increasing regulation. Greater regulatory

scrutiny is here to stay and, while it has the

potential to generate revenue opportunities,

the Board is mindful of its role in ensuring

that the Group has appropriate governance

to meet its obligations. For example, our

UK business is preparing to apply for full

authorisation by the UK Financial Conduct

Authority. In the USA, the Consumer

Financial Protection Bureau oversees our

business and the Board receives an update

at every meeting in relation to the rapidly

evolving regulatory landscape.

The Board is also tasked with ensuring

that the Group has the financial resources

to meet its strategic aims. The capital

measures that form part of our strategic

priorities include making the business as

efficient as possible and generating good

investment returns. To achieve this, as

outlined in the Financial review, we have

deployed new methodologies to assess

investment and acquisition risks, and

changed how we assess and allocate

capital. There is a defined delegation of

authority from the Board and an effective

governance framework in the Group,

within which we can accommodate these

adjustments to our capital allocation

approach. We also enhanced the

reporting to the Board during the year,

so we can more comprehensively

monitor the Group’s performance.

Board effectiveness

The Nomination and Corporate

Governance Committee, under the

chairmanship of George Rose, the Deputy

Chairman, continues to regularly review

the Board’s structure. It does this from a

strategic, long-term perspective, to make

sure we have the most appropriate Board

composition, as well as considering talent

management and succession planning

below Board level.

My priorities this year as Chairman included

the inductions for our new Chief Financial

Officer, Lloyd Pitchford, Chief Operating

Officer, Kerry Williams, and independent

non-executive director, Jan Babiak. Kerry

already has immense experience and

knowledge of Experian’s business, meaning

that much of his induction was focused on

the listed-company aspect of his new role.

Lloyd and Jan undertook a comprehensive

induction programme during the year,

which also included presentations on all

key aspects of Experian’s operations. We

provide more detail on Board induction,

training and ongoing interaction with the

business later in this report.

Chairman’s introduction

“ Effective corporate governance is about more than

adhering to a set of rules. It provides an appropriate

control framework, within which we have developed

our strategic priorities and can execute them to

create long-term value for shareholders.”

Summary

Don Robert Chairman

p12

p38

58 Chairman’s introduction•Governance