Experian 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total revenue from continuing activities in

North America was US$2,468m, up 3%,

while organic revenue declined by 2%. The

difference relates to the acquisitions of

Passport (completed November 2013) and

41st Parameter (completed October 2013).

Credit Services

Total revenue growth was 17% and organic

revenue growth was 7%, with strength

across all major areas of activity. We saw

steady progress in consumer information,

with good demand for credit reference

products as clients prospected for new

credit customers and originated new

loans. Business information performed

strongly, reflecting new business wins

and new product introductions. There was

strength in our automotive vertical, as

growth in automotive sales drove lending

volumes and demand for vehicle history

reports. Finally, we made significant

gains in health, as we secured new client

contracts from hospitals and physician

practices for revenue cycle management

services, and we delivered strong growth

in average order value as we expanded

existing customer relationships.

Decision Analytics

Total revenue growth was 9% and organic

revenue growth was 4%. Against a strong

prior year comparable, Decision Analytics

performed well, reflecting new PowerCurve

credit risk management implementations,

as well as growth in analytics.

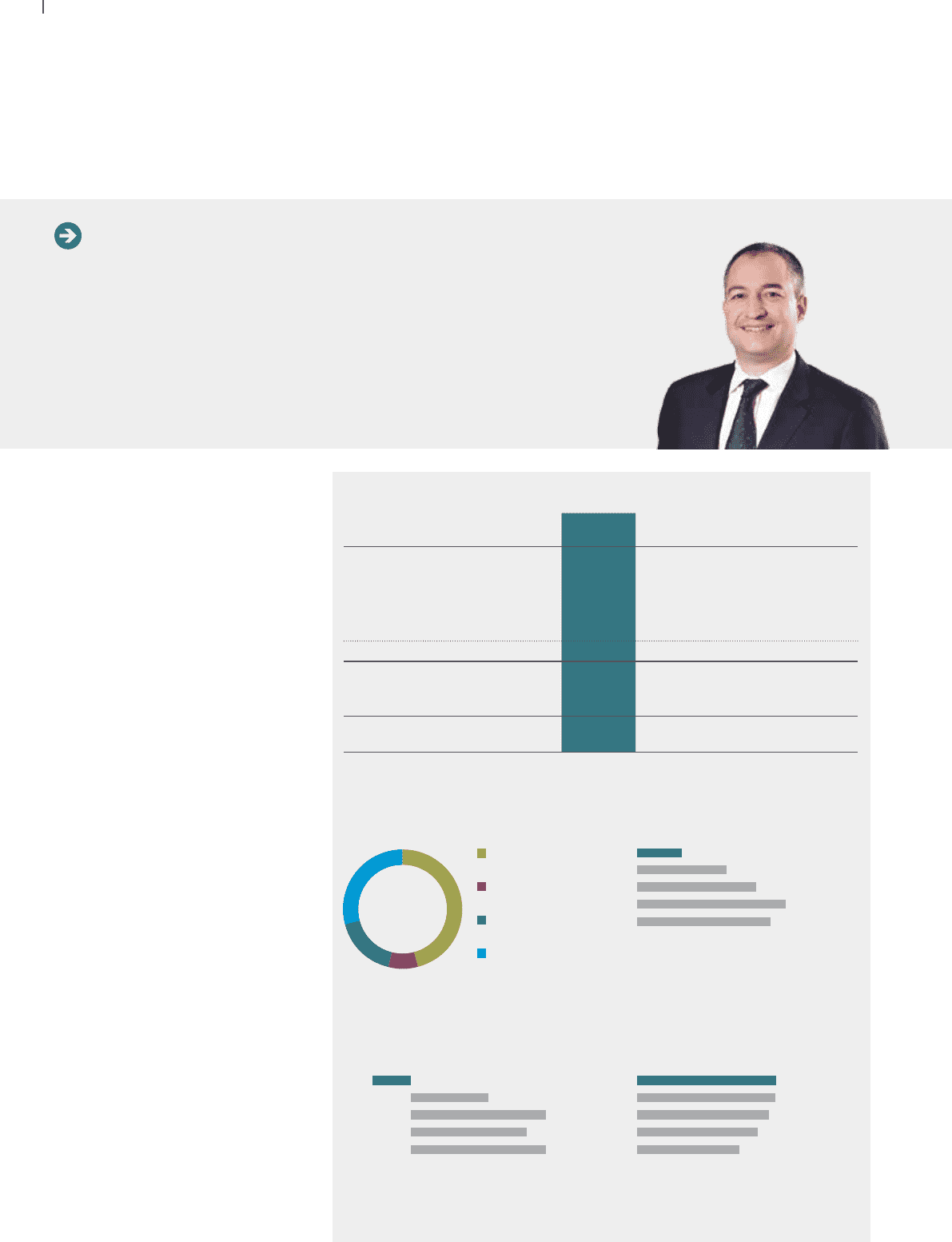

North America

Craig Boundy Chief Executive Officer, North America

“ We delivered strong bureaux performance and stand-

out automotive and health results. We faced challenges

in Consumer Services, but we made encouraging

progress as we transform our consumer offer.”

Summary

Revenue, EBIT and EBIT margin

761m 30.8%

757m 31.5%

718m 31.8%

2015

14

13

658m 31.5%

12

556m 29.2%

11

Revenue by business line

Credit

Services 46%

Decision

Analytics 8%

Marketing

Services 17%

Consumer

Services 29%

(2)%

4%

2015

14

13

6%

12

7%

11

3%

6%

8%

2015

14

13

10%

12

9%

11

Total revenue growth

Organic revenue growth EBIT (US$m) and EBIT margin (%)

7%

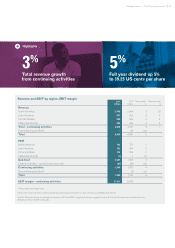

Year ended 31 March

2015

US$m

2014

US$m

Total growth

%

Organic growth

%

Revenue

Credit Services 1,125 961 17 7

Decision Analytics 194 179 9 4

Marketing Services 432 433 – –

Consumer Services 717 831 (14) (14)

Total North America 2,468 2,404 3(2)

EBIT

Total North America 761 757 1

EBIT margin 30.8% 31.5%

30 Strategic report •North America