Experian 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

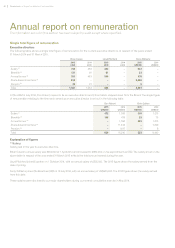

Significant issues

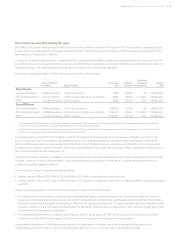

The table below summarises the significant issues considered by the Committee in relation to the Group and Company financial

statements and the manner in which they were addressed. These matters, along with any other key issues covered by the Committee,

are reported to the Board. The Board also receives copies of the minutes of each Audit Committee meeting.

Matter considered Conclusion

Impairment review

A summary of the impairment analysis and underlying

process was provided to the Committee. The Committee

scrutinised the methodology applied by management and

reviewed the cost allocation policies applied. The analysis

showed that the headroom within the Asia Pacific and

EMEA cash generating units (‘CGUs’) had declined during

the year, but that there was still headroom in these CGUs.

The Committee concurred with management’s conclusion that no

impairment of goodwill was required.

The Committee noted the reduced headroom and the sensitivity to

changes in assumptions and concurred with the proposed disclosure

of these in the Group financial statements.

Tax

The Committee received an update from management on

the adequacy of provisions in respect of significant open tax

matters across its principal locations. The review included

details of ongoing correspondence with the UK and Brazil

tax authorities and the principal areas of tax challenge.

The Committee agreed that the assessment of the tax provision was

appropriate and that the judgment taken in respect of the year-end

provision was reasonable.

The Committee noted the evolving and complex tax laws that applied to

the Group and the uncertainty that these might bring. It concluded that

the proposed enhanced Group tax risk disclosures were appropriate.

Brazil litigation

An update was provided to the Committee on the litigation

in Brazil relating to the use of credit scores. The Committee

noted the decision by the Superior Tribunal of Justice in

Brazil which ruled that scores are legal and that the cases

against Serasa had no merit under Brazilian law.

The Committee reviewed the progress made in resolving

the significant number of open cases.

The Committee reviewed and agreed the contingency disclosure

proposed in note 41 to the Group financial statements.

Other litigation and regulatory matters

The Committee received an analysis of the open litigation

and regulatory matters affecting the Group, and the

associated financial reporting considerations.

The Committee concluded that these matters had been appropriately

provided for at 31 March 2015.

The Committee considered and concurred with the proposed contingent

liability disclosures included in the Group financial statements.

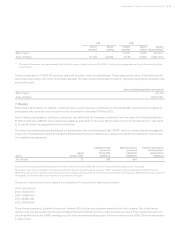

Independence is an important element of

the external audit. The Committee monitors

this during the year, by reviewing potential

threats to independence and the associated

safeguards. These safeguards include

assessing the relationship between the

external auditor and Experian, avoiding

contingent fee arrangements, ensuring

that non-audit services fall within agreed

monetary limits and requiring the external

auditor to consider the potential impact of

non-audit services on their audit services.

Other safeguards are the rotation of the

lead audit engagement partner and the

use of separate teams, where appropriate.

The Committee concluded that the external

auditor had maintained independence

throughout the year.

Based on the outcome of the evaluation

of the external auditor, the reports on the

audit process that the Committee reviewed

and the conclusion that the external auditor

and the Group had complied with the

FRC’s Guidance on Audit Committees, the

Committee recommended to the Board

(for shareholder approval) that the external

auditor be re-appointed.

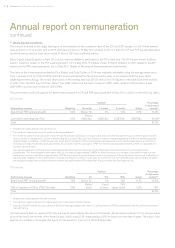

Non-audit services

PricewaterhouseCoopers LLP provides

a range of other services to Experian,

which include tax compliance and

advisory services. To ensure auditor

objectivity and independence, the

Company has a policy in relation to

providing such services, which includes

financial limits above which the Chairman

of the Audit Committee must approve any

proposed non-audit services.

The Committee receives half-yearly reports

detailing non-audit assignments carried

out by the external audit firm, together with

the related fees. Non-audit fees paid to the

Company’s auditor are capped at 100% of

the fees for audit and assurance services,

except in exceptional circumstances. An

analysis of fees paid to the external auditor

for the year ended 31 March 2015 is set out

in note 12 to the Group financial statements.

Corporate governance report continued

76 Governance •Corporate governance report