Experian 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Loss or inappropriate

use of data

• New legislation or regulatory

and enforcement changes

• Increasing competition

• Material regulatory

enforcement actions and

adverse litigation claims

• Adverse and unpredictable

business and financial markets

• Ineffective business execution

• Non-resilient or non-agile

IT environment

• Business conduct risk

• Dependence on highly

skilled personnel

• Data ownership,

access and integrity

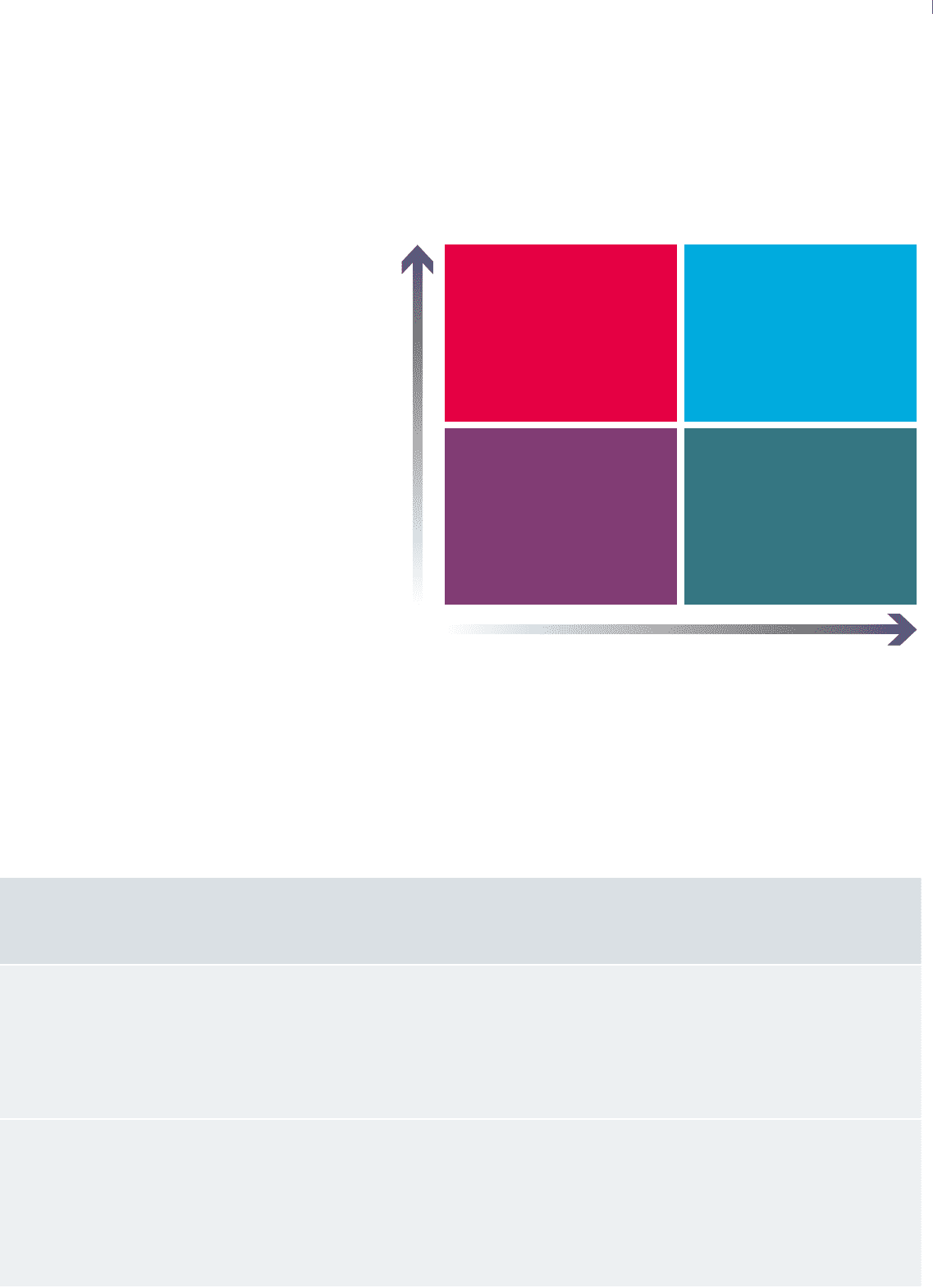

IMPACT

PRINCIPAL RISK PROFILE

LIKELIHOOD

2015 risk assessment

Our businesses and strategy expose the

Group to a number of inherent risks. The

Board has carefully considered the type and

extent of the significant risks it is willing to

take, so the Group can achieve its strategic

objectives and deliver a satisfactory return to

shareholders. The diagram summarises our

principal risk profile.

Over time, the Group’s risk profile evolves. As

a result, we have updated the principal risks to

reflect the Board’s view of the most important

risks currently facing the Group. We have

added a new risk in respect of business

conduct risk and expanded our discussion

of risks associated with ineffective business

execution and adverse and unpredictable

financial markets.

We have also updated the descriptions for

other risks. Each principal risk is described

on the following pages, together with its

relevance to strategy, our mitigating actions

and an overview of the risk trend during 2015.

How do we

manage the risk?

How has the

risk changed

since 2014?

What is the risk’s

status for 2015?

• We have a number of defensive and proactive practices

across the Group, based on our global security policies

• A programme of continuous measurement and alerting helps

ensure that we quickly highlight areas of risk in our business

practices and manage them accordingly

• Our enterprise risk management framework works to create

transparency across layers of management and seeks to

ensure we have appropriate oversight of data security, privacy

and protection

Increasing risk,

reflecting the

intensity of threats

companies are

facing from cyber

attacks, both

domestic and

foreign

We continue to invest in IT security and to execute a sound

security strategy that results in layered protections across our

technology infrastructure. We maintain strong contractual

requirements for partners and other third parties who use

our data and periodically review third-party controls. New

and emerging tools give us increased visibility into technical

systems, with a keen focus on identifying suspicious activities.

The evolving attack environment is driving a larger dependence

on threat intelligence and fine tuning our capabilities, so we can

track and respond to a myriad of potentially malicious factors

• We educate lawmakers, regulators, consumer and privacy

advocates, industry trade groups, our clients

and other stakeholders in the public policy debate

• Our global compliance team has region-specific

regulatory expertise and works with our businesses

to identify and adopt balanced compliance strategies.

This is complemented by executing our Seven Elements

of Compliance Programme that directs the structure,

documentation, tools and training requirements to

support manager compliance on an ongoing basis

Increasing risk and

increasing costs,

associated

with compliance

and data

governance

process

From 1 April 2014 the UK Financial Conduct Authority has

regulated credit bureaux in the UK. Experian currently operates

under an interim permission and is in the process of obtaining

its full permission. We continue to face increasing regulatory

compliance risk related to, amongst other things consumer

protection and privacy, as there is still no certainty as to the

impact of the rule making, investigative and enforcement powers

of the various global regulatory and administrative bodies on

our Credit and Consumer Services businesses. We continue

to refine our compliance strategies in response to developing

requirements of these agencies

17Strategic report •Protecting our business