Experian 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

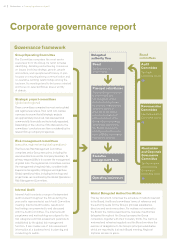

Board, committee and director

effectiveness review

An independent external evaluation of

Board and committee effectiveness was

carried out in March 2014 by Sheena

Crane, who had no connections with the

Group. This was the first year of the Board’s

three-year review cycle. Following that

evaluation, the Board set areas of focus

for 2014/15. Given the depth of Ms Crane’s

external evaluation, the second year of

the cycle involved the Board performing

an internal evaluation of where it stood

versus last year’s areas of focus and the

resulting actions, as well as agreeing areas

of focus for the coming year. The third year

of the cycle, to be undertaken next year, is

intended to be an interview/questionnaire-

based internal evaluation.

This year’s internal evaluation comprised

a discussion on the Board’s effectiveness

at the January 2015 Board meeting,

based on materials circulated before

the meeting. These materials included

management’s update to the Board on

the status of the focus areas and resulting

actions, following last year’s external

evaluation. There were also separate

meetings between each director and the

Chairman, in relation to the director’s

performance. The Deputy Chairman and

Senior Independent Director evaluated the

Chairman, taking account of input from

the Chief Executive Officer and the other

directors. Each principal Board committee

also evaluated its own performance.

At the January 2015 meeting, the

Board noted that there had been good

progress against the agreed areas of

focus. In particular:

Strategy – The strategy-setting process has

enhanced the Board’s consideration of long-

term market opportunities and the Group’s

growth ambitions beyond the traditional

planning horizon. The Board also receives

more regular updates on key development

projects and domain knowledge topics.

Specific action plans have been developed

for each key strategic initiative.

Regulatory environment – The Audit

Committee receives a regular compliance

update, including the impact on the

business of UK Financial Conduct Authority

and US Consumer Financial Protection

Bureau regulation. The Board also receives

a regulatory update at every meeting. Below

Board level, these matters are kept under

ongoing review throughout the business.

Training continues to focus on regulatory

compliance and information security.

Risk management – The Board is

considering the Group’s risk appetite in

the context of the 2014 revisions to the

UK Corporate Governance Code and

associated guidance. A large amount of

work has already been done to enhance

the risk-related elements of the Group’s

acquisition and integration processes,

including developing internal guidance,

expanding the frequency and depth of

post-investment reviews and carrying out

detailed risk assessments immediately

post-acquisition.

Succession and talent development

– Following a number of Board changes

over the past 18 months, the Nomination

and Corporate Governance Committee

will increase its focus on succession

planning for the broader executive team and

development plans for identified short- to

medium-term successors. This includes

opportunities for top talent to meet the non-

executive directors, as part of Board visits

to the business and other presentations to,

and interactions with, the Board.

Board development – The Board visited

Madrid, Spain, in September 2014, Costa

Mesa, California, in March 2015, and

will visit São Paulo, Brazil, in September

2015. The programme of overseas Board

visits will be considered regularly, as

part of the normal review of the Board’s

annual meeting schedule. The structure of

overseas Board visits has been reviewed,

to incorporate both geographic and

strategic business areas and domain

knowledge focus areas.

Year 1 (2014)

Evaluation by external facilitator

Year 2 (2015)

Internal review against detailed Year 1 review

Year 3 (2016)

Interview/questionnaire-based, internal evaluation

Board’s three-year effectiveness review cycle

65Governance •Corporate governance report