Experian 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

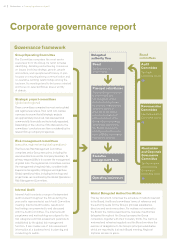

Risk management

and internal control

The Board is responsible for establishing,

maintaining and reviewing sound risk

management and internal control systems.

There is an ongoing process in place for

identifying, evaluating and managing the

significant risks Experian faces, including

risks relating to social, ethical and

environmental matters. This process was

in place for the financial year and up to the

date of approval of this Annual Report.

Risk management is an essential element

of running a global, innovation-driven

business like Experian. It helps to achieve

long-term shareholder value and to protect

the Group’s business, people, assets, capital

and reputation. It operates at all levels

throughout the organisation, across regions,

business lines and operational support

functions. Experian’s approach to risk

management encourages clear decisions

about which risks are taken and how they

are managed, based on an understanding

of their potential strategic, commercial,

financial, compliance, legal and reputational

implications. Details of our ‘three lines

of defence’ overview of risk and control

responsibilities appear overleaf. The defence

model provides assurance to the Board that

risks are reduced to a manageable level, as

dictated by the Group’s appetite for risk.

As risk management and internal control

systems are designed to manage rather

than eliminate the risk of failure to achieve

business objectives, they can provide

reasonable, but not absolute, assurance

against material financial misstatement

or loss. For certain joint arrangements,

the Board relies on the systems of internal

control operating within the partners’

infrastructure and the obligations of

the partners’ boards, relating to the

effectiveness of their own systems.

Principal features of the risk management and internal control framework

Experian’s risk management framework provides a structured and consistent process for identifying, assessing, responding to and

reporting risks. It enables management to demonstrate a responsible and proactive embedded approach to risk management. In

doing so, the Board’s main functions are supported by identifying and managing risk, in line with our strategic objectives, risk appetite,

corporate responsibility strategy and the long-term drivers of our business.

Tone at the top Business strategy

Focus on key

strengths

Seize growth

opportunities

Deliver

performance

improvements

Operational

efficiency

Optimise capital

Sustaining

a culture of

integrity and

ethical values

Commitment to

competency

Commitment to

maintaining a

strong risk and

control culture

Risk management and internal control framework

Defined

governance

structure

Communicate

Identify

risks

Evaluate

control

environment

Respond

to risks

Monitor

69Governance •Corporate governance report