Experian 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Highlights

EBIT (US$m)

with 31.4% margin

314m4%Organic revenue

growth

21%Contribution to

Group revenue

Decision Analytics

At constant exchange rates, total

and organic revenue growth was 3%.

Momentum in Decision Analytics

improved as the year progressed, with a

stronger finish to the year. Growth was

driven by software and analytics, including

new adoptions for our PowerCurve

credit decisioning platform, and there

was good progress in fraud and identity

management, driven by authentication

and anti-money laundering products. We

also saw a growing contribution from 41st

Parameter device identification, following

several wins across a broad range of

industry segments.

Marketing Services

At constant exchange rates, total and

organic revenue growth in Marketing

Services was 1%. We saw strong growth

in cross-channel marketing, driven by

sales to existing clients and new business

wins, including a major win in the financial

services segment. There was also further

progress across data quality, which

ended the year well, with encouraging

new business performance. These offset

contraction in targeting data.

Consumer Services

Consumer Services performed well, with

total and organic revenue growth of 8% at

constant exchange rates. Growth reflected

further momentum in the direct-to-

consumer operations, with growth in new

membership subscriptions during the year.

While it is a relatively small component of

the business, there was strong growth in

the affinity channel, with additional new

wins during the year.

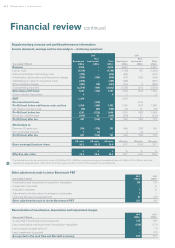

EBIT and EBIT margin

For the UK and Ireland, EBIT from

continuing activities was US$314m, up

11% at constant exchange rates. The EBIT

margin increased by 130 basis points

to 31.4%, reflecting positive operating

leverage and good cost containment

across all areas.

999mRevenue

(US$m)

Helping schools become

Centres of Excellence

We worked with pfeg, the UK’s

leading financial education charity, to

help provide children with the skills,

knowledge and confidence they need

to manage their money when they

grow up. Now in its third year, nearly

10,000 pupils have received financial

education and 14 schools have become

Centres of Excellence in financial

education. We expect to reach 24,000

pupils and help 28 schools receive this

standard of excellence in the next year.

35Strategic report •UK and Ireland