Experian 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chief Executive’s review

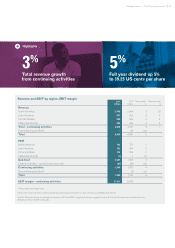

As expected, organic revenue improved

as we exited the year. For the year, total

revenue growth from continuing activities

was 1% at actual rates, 3% at constant

exchange rates, and organic revenue

growth was 1%. This represented flat

organic revenue in the first three quarters

of the year and 3% in the final quarter,

with the uplift coming mainly from

improved performances in North

America Consumer Services and

Decision Analytics.

We saw strong growth during the year

from North America Credit Services, the

UK and Ireland, and across Asia Pacific.

Latin America showed good progress

despite the subdued economy in Brazil,

and whilst North America Consumer

Services was a headwind, we’ve made

further progress towards transforming our

consumer proposition and leveraging the

Experian.com brand.

We generated significant cash flow during

the year, enabling us to support our growth

ambitions, announce increasing returns

to shareholders and reduce net debt. We

grew Benchmark EPS by 8%, at constant

exchange rates and 4% at actual rates,

increased equity dividends by 5%, and

reduced net debt by US$592m, while

continuing to invest for growth.

Regional highlights

North America

In North America, we made further progress

across Credit Services and Decision

Analytics; Marketing Services was stable

and we’ve taken a number of important steps

to reposition Consumer Services.

Our core consumer bureau continued

to perform well as the environment for

lending improved with steady expansion

in volumes. Performance was further

boosted by strong growth across the

non-consumer bureau component, now

accounting for around 40% of Credit

Services revenue in North America.

Business information recovered well,

following the actions we’ve taken to

strengthen and refocus our activities.

Automotive had another outstanding year

as we increase market penetration with

dealers, manufacturers and auto-lenders,

and I’m delighted with the progress

we’ve made in health, where Passport

has exceeded our expectations. The

integration of Passport has gone smoothly

and we’re seeing significant growth in

both bookings and implementations as

we expand our position with existing

hospital and physician clients and add

new ones. We’re also laying foundations

to expand our product range, to address

new healthcare segments in the future.

Decision Analytics had another solid

year, fuelled by significant software

deals, and we’re making considerable

progress in analytics, as lending activity

picks up and clients seek tools to refine

their decision making and ability to

segment the market effectively.

In Marketing Services, we saw strong growth

in cross-channel marketing offset by some

attrition on legacy email products. We’re

making steady progress in cross-channel,

with a good pipeline of prospects which

we’ll seek to convert over the coming year.

We’re encouraged by progress in North

America Consumer Services. Whilst

uncertainty remains and we continue

to invest in the brand and products to

move the business forward, we believe

we have passed the peak rate of decline.

Our strategy is focused on transforming

our consumer offering by differentiating

ourselves as a data owner and providing

a compelling consumer experience, while

also using our firepower in consumer

marketing to make Experian.com the

principal brand for consumers. Key

milestones in the year included making

FICO scores available to consumers

through Experian.com, which we launched

in December 2014. Response rates since

have been favourable, with an increase in

membership revenue for Experian.com of

14% year-on-year in the fourth quarter of

the year. A further development took place

in March when we successfully migrated

freecreditreport.com customers to

Experian.com. This was an important step

as we seek to simplify our platforms and

to generate operational efficiencies. Over

the coming year we expect to introduce

additional functionality in order to further

enhance the consumer experience,

and with this we expect to make further

steady progress throughout the year

ending 31 March 2016 in North America

Consumer Services.

Brian Cassin Chief Executive Officer

“ I am pleased to report that we achieved a positive

outcome during a year of transition for Experian.

Earlier this year, we laid out five key strategic priorities

to position the Group for sustained growth and we’re

executing well against the key elements of our plan.”

Introduction

24 •Strategic report Chief Executive’s review