Experian 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review continued

Capital allocation and returns

Capital allocation

During the year ended 31 March 2015,

the Group reviewed its capital allocation

framework as part of the strategic priority

to rigorously optimise capital. This review

encompassed our risk and capital returns

framework, our balance sheet structure,

and the scope and mechanism for future

shareholder returns.

The key conclusions of our review,

announced in January 2015, were that:

• the Group has strong cash generation

potential, which provides substantial

cash flow for investment, both organic

and inorganic, to meet the Group’s

strategic goals;

• the capital allocation process can

provide greater emphasis on the

assessment of risk in the investment

appraisal process;

• there is scope to enhance the

efficiency of the capital structure,

whilst sustaining strong investment-

grade credit ratings and sufficient

flexibility for future investment;

• the Group’s strong cash profile

provides the potential to progress

the level of the ordinary dividend

payment over time; and

• the rate of future cash generation

is expected to continue to provide

residual capital, for additional returns

to shareholders.

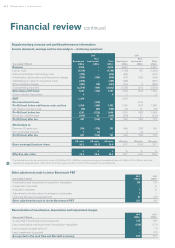

Medium-term financial framework

The Group’s aspiration is to deliver average

annual growth in organic revenue in the

mid single-digit range. Our focus is on

growing our core businesses with their

track record of robust operating margins

and strong cash generation. By applying

our cash flows into organic investment

opportunities, acquisitions and returns of

excess capital to shareholders, we have the

potential for strong growth in Benchmark

EPS. This medium-term financial framework

is illustrated in the chart below.

Organic investment

Our priority is to allocate capital in

support of our growth ambitions, whilst

driving business efficiency and generating

good investment returns. We will prioritise

growth investment in core activities.

Acquisitions will continue to form part of

the investment mix, assessed by a range

of stringent criteria.

Capital expenditure in the year ended

31 March 2015 was US$380m (2014:

US$402m), representing 7.9% (2014:

8.3%) of revenue. Expenditure through

the income statement in support of

growth initiatives included spend on

Data Labs in three regions, sales force

transformation and training, restructuring

and productivity initiatives.

We have already agreed process changes

to support these priorities and we are

embedding them in the business. We

have changed the way we assess risk

and the way we allocate capital internally,

with a more prominent focus on ROCE

and internal capital rationing. We require

organic and inorganic investment returns

to be significantly in excess of the Group’s

weighted average cost of capital.

Acquisitions and

portfolio management

We will test all acquisition proposals

against the use of capital for share

repurchases. We will continually

evaluate peripheral activities and, where

appropriate, rationalise accordingly.

Organic business Operating cash flow application

Medium-term financial framework

Organic investment

• Core focus

and optimised

• Capital expenditure

at 8% to 9% of revenue

• P&L investments

Optimised capital allocation

Strong growth in Benchmark earnings per share

Mid single-digit

organic revenue growth

• Structural growth

• High quality

• Strong cash generation

• Strong core and

portfolio optionality

Portfolio

• Non-core disposals

• Acquisitions focused

on core business

• Returns focus

• Discipline

Shareholder returns

• Efficient structure

• Progressive dividend

• Share purchases

42 Strategic report •Financial review