Experian 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chief Executive’s review continued

Capital optimisation: earlier this year

we conducted a thorough review of our

capital plans to sharpen focus on capital

allocation. We’ve since implemented

changes in the way we assess risk and

how we allocate capital internally, with

a more prominent focus on returns. We

also seek to balance flexibility to invest,

with optimisation of our cost of capital

and balance sheet prudence, and as a

result we announced changes in January

2015 to our target debt ratios and dividend

policy. We also initiated a share repurchase

programme, which is targeted to complete

by 31 March 2016.

Other items

Cash generation and uses of cash

Cash generation during the year was

strong, with EBIT conversion into

operating cash flow of 104%, compared

to 101% in the previous year. Operating

cash flow increased to US$1,359m from

US$1,321m in 2014. During the year,

US$380m was utilised in organic capital

investment, and US$67m supported

acquisitions, principally a small credit pre-

qualification business in the UK. Share

purchases amounted to US$192m.

In January 2015 we announced a US$600m

share buyback programme, of which

US$64m had been completed by the

end of March 2015.

Equity dividends paid amounted to

US$374m, and after other small inflows a

balance of US$592m was used to reduce

net debt. At 31 March 2015, net debt was

US$3,217m, representing 1.9 times EBITDA

for the last twelve months, and just below

our target debt range of 2.0 to 2.5 times.

Return on capital employed

Return on capital employed (‘ROCE’)

for the year was 14.9% (2014: 15.6%). As

expected, ROCE reduced during the year

due to the effect of the Passport and 41st

Parameter acquisitions made during 2013.

Excluding this effect ROCE progressed by

110 basis points during the year.

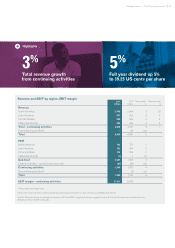

Dividend

For the year ended 31 March 2015, we’re

announcing a second interim dividend

of 27.00 US cents per share. This gives a

full year dividend of 39.25 US cents per

share, up 5%, consistent with our policy

of growing the dividend in line with or

ahead of Benchmark earnings. The second

interim dividend will be paid on 24 July 2015

to shareholders on the register at the close

of business on 26 June 2015. If the current

foreign exchange rate (£1=US$1.54 as at

11 May 2015) prevails when the second

interim dividend is translated, the full

year dividend expressed in sterling would

increase by 16%.

People

Finally, I would like to acknowledge the

tremendous effort by all the people of

Experian during the past financial year.

While it was a year of some challenges,

we delivered a successful outcome and

I am incredibly proud of how committed

everyone is to pushing the business

forward. The energy I see across the

business is palpable and I am confident

that we’ll make great progress in the

coming year, delivering on the many

exciting initiatives we have across

the Group.

28 Strategic report •Chief Executive’s review