Experian 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

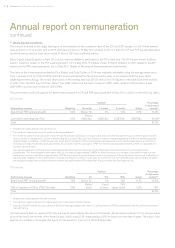

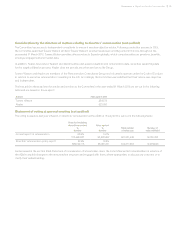

The figures for UK and Ireland employees reflect average salaries and average employee numbers each year. The annual bonus figure

includes payments from sales incentive plans.

Base salary Taxable benefits Annual bonus

CEO(1) (15.3)% (50.8)% (36.4)%

UK and Ireland employees 3.1% (9.8)% (13.9)%

(1) Data for the CEO reflects data for Brian Cassin for 2015 and Don Robert in 2014. Don Robert’s salary, benefits and bonus for 2014 have been translated from US

dollars into sterling at the average exchange rate for 2014 of £1:US$1.59.

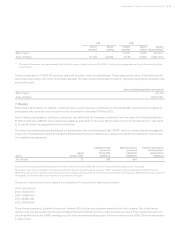

Relative importance of spend on pay (not audited)

The table below illustrates the relative importance of remuneration spend for all employees, compared to the financial distributions to

shareholders, through dividends and earnings-enhancing share repurchases, over the same period.

2015

US$m

2014

US$m

%

change

Employee remuneration costs 1,799 1,830 (1.7)%

Dividends paid on ordinary shares 374 349 7.2%

Estimated value of earnings-enhancing share repurchases 66 191 (65.4)%

Statement of implementation of remuneration policy in the following financial year (not audited)

The remuneration policy was approved by shareholders at the AGM on 16 July 2014 and the Committee intends to implement this policy

for the three years to July 2017.

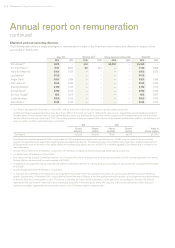

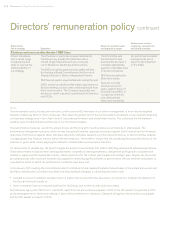

Salary and fees

The salaries that apply from 1 April 2015 are set out in the following table.

Salary to 31 March 2015 Salary from 1 April 2015 % increase

Brian Cassin £850,000 £875,000 2.9%

Lloyd Pitchford £525,000 £540,000 2.9%

Kerry Williams US$900,000 US$925,000 2.8%

In September 2013, the Board reviewed the fees of the non-executive directors, as it normally does every two years. Based on supporting

market data, the following fees were implemented from 1 October 2013. The next review will be in September 2015.

Base fee €132,500

Audit Committee Chairman fee €40,000

Remuneration Committee Chairman fee €32,000

Deputy Chairman/Senior Independent Director fee €80,000

Non-executive directors required to undertake intercontinental travel to attend Board meetings receive a supplementary payment of

€6,000 per trip, in addition to any travel expenses. This amount is unchanged since October 2009.

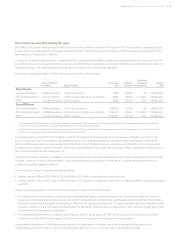

Clawback provisions

In line with the revised UK Corporate Governance Code issued in September 2014, the Committee has formally introduced clawback

provisions. These will apply to the annual bonus plan and the Plans, as set out in the following table.

Plan Period of time clawback will apply for First application

Annual bonus – paid in cash Three years following the end of the bonus year Bonus earned in respect of FY16

(i.e. paid in June 2016)

Annual bonus – invested in CIP Three years following the end of the bonus year

(deferral period)

Bonus earned in respect of FY16

(i.e. deferred in May/June 2016)

CIP matching awards One year following the end of the performance period Awards made in respect of FY16

deferred bonus (i.e. made in May/June 2016)

PSP awards One year following the end of the performance period Awards made in May/June 2015

Clawback will not apply to the annual bonus payable in 2015 or the CIP award to be granted in 2015 because the terms of these

arrangements had already been put in place prior to the Committee’s decision to implement clawback.

91

Governance •Report on directors’ remuneration