Experian 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate responsibility continued

Key corporate responsibility facts

Providing financial education

14 schools

In the UK, we have helped 14 schools

become recognised as Centres of

Excellence in financial education

Giving our time to help

39,139 hours

Our people volunteered 39,139 hours during

and outside of work to help support financial

education and local communities

Helping people understand

and manage their finances

People with a poor credit profile are

often seen as high risk by lenders, which

invariably means they are turned down for

credit or only offered it at a higher interest

rate. The sad consequence is that the very

people who are the least able to afford

services have to wait longer or pay more.

Through our consumer services like Credit

Tracker in the USA or CreditExpert in the

UK, we help people to understand their

credit profile, what affects it and how

to use it to get what they need. In North

America, our teams of Credit Educators

are available to provide support. In Brazil,

we piloted an expansion of our successful

Real Dreams financial education

programme, turning its attention to helping

small business entrepreneurs in São Paulo

learn how they can grow their business.

Following this success, we are looking to

expand this to other parts of the country.

Unpaid or excessive debt can affect

people’s lives, not just their credit scores.

So we invest in helping individuals and

businesses to understand how to manage

their finances. For example, more than

four million people in Brazil are registered

on our free online Recovery Portal, which

helps borrowers and lenders reach a

compromise to stop unmanageable debts

spiralling out of control. As a direct result

of the use of this service, over 1.1 million

debts, worth more than US$1.6bn, have

been repaid since its launch in July 2013.

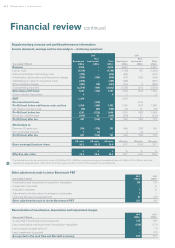

Community investment*

2015

US$’000s

2014

US$’000s

Funds from Experian plc 3,310 2,299

Financial donations and investments

from Experian subsidiaries 1,565 2,347

Employee time volunteered 1,173 1,056

Gifts in kind 503 604

Management costs 937 605

Total from Experian 7,488 6,911

As % of Benchmark PBT 0.61% 0.56%

Employee fundraising 1,109 1,270

Out of work volunteering enabled by Experian 643 873

Total value of all giving 9,240 9,054

As % of Benchmark PBT 0.75% 0.73%

* For more information on how these figures are calculated, see the Reporting Principles and

Methodology at www.experianplc.com/responsibility

We tailor our long-standing financial

education programmes to local needs.

In the UK, 14 schools in some of the

country’s most disadvantaged areas have

become recognised Centres of Excellence

in financial education, through our

partnership with pfeg, a leading money

education charity. In North America, we

work with the Credit Builders Alliance to

train service providers to educate their

customers about managing finances. We

also launched a new financial education

product at the end of 2015, created through

the contributions of our employees in

our Social Innovation programme, which

enables small business owners to learn

what affects their commercial credit scores.

Our employees around the world

contribute their time, expertise and

enthusiasm to support these financial

education activities.

Safeguarding data and privacy

We manage vast amounts of data about

people and businesses. The continued

success of our business depends on our

ability to protect that data.

We have extensive and robust security

systems, with built-in safeguards against

physical threats and continually evolving

cyber attacks. Everyone at Experian is

personally responsible for data protection,

with support from dedicated security

teams. We also extend data protection

requirements to third-party suppliers and

partners, through our contracts.

Our Global Information Values set clear

expectations about how we use data across

the business, and our compliance principles

ensure effective governance, training and

risk management. Global Internal Audit

monitors our data protection activities.

54 Strategic report •Corporate responsibility