Experian 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance report

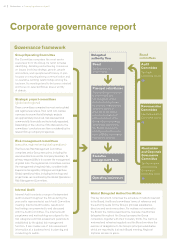

Governance framework

Delegated

authority flow

Board

committees

Board

See Board section

which follows.

Principal subsidiaries

These are Group companies

to which the Board

has delegated certain

decision-making powers,

for example implementing

decisions agreed in

principle by the Board;

executive management

of the operations of the

Group within the strategy

and budget approved by

the Board; acquisitions

and disposals with a value

up to US$20m, and capital

expenditure projects.

Executive

management team

Operating businesses

Global Delegated Authorities Matrix

This key document comprises the schedule of matters reserved

to the Board, the Board committees’ terms of reference and

the authority levels for the Group’s principal subsidiaries,

directors and senior executives. For matters not reserved to

the Board, the matrix prescribes the cascade of authorities

delegated throughout the Group by respective Group

companies, together with their monetary limits. The matrix is

reviewed and refreshed regularly and the Board monitors the

exercise of delegations to the Group’s principal subsidiaries,

which are reported to it at each Board meeting. Regional

matrices are also in place.

Group Operating Committee

The Committee comprises the most senior

executives from the Group. Its remit includes

identifying, debating and achieving consensus

on issues involving strategy, growth, people

and culture, and operational efficiency. It also

focuses on ensuring strong communication and

co-operative working relationships among the

top team. Its meetings tend to be issues oriented

and focus on selected Group issues worthy

of debate.

Internal Audit

Internal Audit conducts a range of independent

audit reviews throughout the Group during the

year and is represented at each Audit Committee

meeting. Internal Audit’s plans, results and

key findings are presented to and discussed

with the Audit Committee. The internal audit

programme and methodology are aligned to the

risk categories and risk assessment parameters

established by the global risk management

function. It also makes use of risk assessment

information at a business level, in planning and

conducting its audits.

Strategic project committees

(global and regional)

These committees comprise the most senior global

and regional executives. Their remit is to oversee

a process to ensure that all strategic projects

are appropriately resourced, risk assessed and

commercially, financially and technically appraised.

Depending on the outcome of the discussions, the

committees’ conclusions are then considered by the

relevant Group company for approval.

Risk management committees

(executive, regional and global operations)

The Executive Risk Management Committee

comprises senior Group executives, including the

executive directors and the Company Secretary. Its

primary responsibility is to oversee the management

of global risks. The regional risk committees oversee

the management of regional risks, consistent with

Experian’s risk appetite, strategies and objectives.

Global operational risks, including technology and

project risks, are monitored by the Global Operations

Risk Management Committee.

Audit

Committee

See Audit

Committee report.

Nomination

and Corporate

Governance

Committee

See Nomination

and Corporate

Governance

Committee report.

Remuneration

Committee

See Remuneration

Committee report.

p74

p78

p72

62 Governance •Corporate governance report