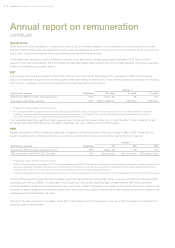

Experian 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

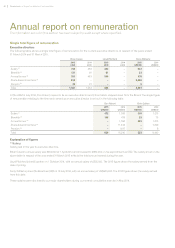

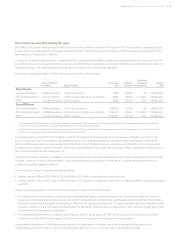

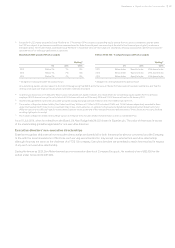

Plan interests awarded during the year

On 19 May 2014, awards were granted to Brian Cassin and Kerry Williams under the CIP and the PSP. The face value of awards to Brian

Cassin is given in sterling and the face value of awards to Kerry Williams is given in US dollars, using the average exchange rate for the

three days prior to grant of £1:US$1.68.

In line with the rules of the Experian Co-investment Plan, invested shares for Brian Cassin were purchased with his bonus net of tax. In

line with the rules of the Experian North America Co-investment Plan, invested shares for Kerry Williams were calculated with reference

to his gross bonus. The matching awards are based on the gross value of the bonus deferred.

The details of awards granted on 19 May 2014 are set out in the following table.

Type of interest

in shares Basis of award

Face value

000

Number

of shares

Vesting at

threshold

performance

Vesting

date

Brian Cassin

CIP invested shares Deferred shares 100% of net bonus £245 23,856 n/a 19 May 2017

CIP matching shares(1) Nil-cost options 200% of value of gross bonus deferral £925 90,024 1:1 match 19 May 2017

PSP(2) Conditional shares 200% of salary £925 87,319 25% 19 May 2017

Kerry Williams

CIP invested shares Deferred shares 100% of gross bonus US$736 41,325 n/a 19 May 2017

CIP matching shares(2) Conditional shares 200% of value of gross bonus deferral US$1,471 82,650 1:1 match 19 May 2017

PSP(2) Conditional shares 200% of salary US$1,800 101,135 25% 19 May 2017

(1) The award granted to Brian Cassin under the Experian Co-investment Plan was based on the share price at which invested shares were purchased in the

market. This price was £10.28 and was used to determine the number of shares awarded.

(2) Awards under the Experian North America Co-investment Plan and PSP were based on the average share price for the three days prior to grant, which was

£10.59. This figure was used to determine the number of shares awarded.

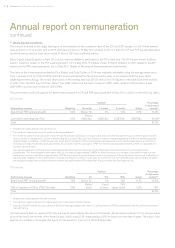

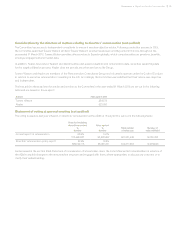

On joining Experian, Lloyd Pitchford forfeited a number of long-term incentive awards from his previous employer. As set out in last

year’s Annual report on remuneration, and detailed as part of our normal consultation exercise to major shareholders in May 2014,

the Committee’s approach to compensating Lloyd Pitchford for his forfeited incentives was in line with its belief in not over-paying on

recruitment and that any replacement share incentives (‘buyout awards’) would take into account the likely vesting and resulting value of

the share incentives that were being given up.

Whilst the Committee aimed to replicate as closely as possible the structure and vesting dates of the share awards that Lloyd Pitchford

forfeited, it was also mindful of shareholders’ views that vesting periods should be a minimum of 12 months and that performance

conditions should be applied to awards.

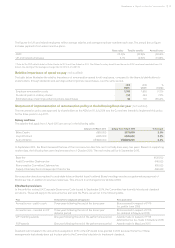

Lloyd Pitchford’s historic share awards were as follows:

• awards vesting in March 2015, March 2016 and March 2017, with no performance conditions; and

• awards vesting in March 2015, March 2016 and March 2017, subject to satisfying performance conditions based on earnings per share

and TSR.

The buyout awards granted to Lloyd Pitchford have therefore been structured as follows:

• The awards with no performance conditions were replaced with awards of Experian shares with a similar face value and, with the

exception of the award that had been due to vest in 2015, these will vest on the normal vesting dates in March 2016 and March 2017.

The buyout award, for the original award vesting in March 2015, was structured to vest 12 months from the date Lloyd Pitchford joined

Experian. Vesting of the buyout awards will be subject to satisfactory financial and business performance over the vesting period and

the achievement of his personal objectives.

• The awards with performance conditions were replaced with an award under the PSP, which is subject to the same performance

conditions as other PSP awards made in 2014 and will vest at the end of the three-year performance period.

In establishing the quantum of the replacement awards, an independent consultant was used to estimate the fair value of the

outstanding awards so this value could be replicated after taking into account the fair value of the Experian awards.

85

Governance •Report on directors’ remuneration