Experian 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual bonus

Other than the formal introduction of clawback provisions, the Committee’s approach to operating the annual bonus plan for the year

ending 31 March 2016 will be unchanged from 2015. Under the clawback provisions, the Company may recover part, or all, of any annual

bonus paid, at any time during the three years following the end of the financial year.

In line with previous practice, the Committee has chosen not to disclose the annual bonus target calibration for 31 March 2016 for

reasons of commercial sensitivity. If the Committee decides that targets have ceased to be commercially sensitive, they will be disclosed

in the next available remuneration report.

CIP

The executive directors have elected to defer 100% of their bonus into the CIP. Matching shares, equivalent to 200% of the invested

bonus, are expected to be granted in the first quarter of the year ending 31 March 2016. These will vest subject to satisfying the following

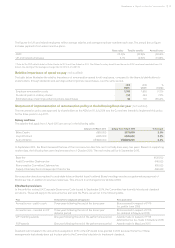

performance conditions, which will be measured over a three-year performance period:

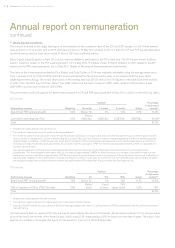

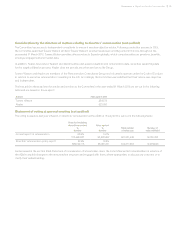

Performance measure Weighting

Vesting(1) (2)

No match 1:1 match 2:1 match

Benchmark PBT per share (annual growth) 50% Below 4% 4% 8%

Cumulative operating cash flow 50% Below US$3.6bn US$3.6bn US$4.0bn

(1) Straight-line vesting between the points shown.

(2) The vesting of awards is subject to the Committee being satisfied that the vesting is not based on financial results which have been materially misstated.

In addition, the Committee has the discretion to vary the level of vesting if it considers that the level of vesting determined by measuring performance is

inconsistent with the Group’s underlying financial and operational performance.

The cumulative operating cash flow target range is lower compared to last year to take into account the effect of the movement in key

exchange rates impacting the Group (US dollar to Brazilian real, euro, sterling and Colombian peso).

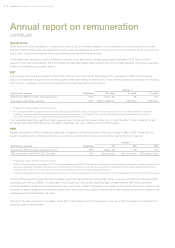

PSP

Awards equivalent to 200% of salary are expected to be granted in the first quarter of the year ending 31 March 2016. These will vest

subject to satisfying the following performance conditions, which will be measured over a three-year performance period:

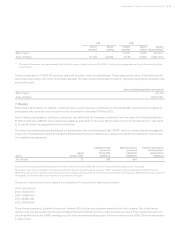

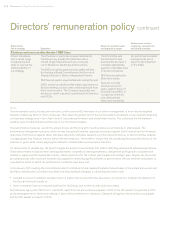

Performance measure Weighting

Vesting(1) (2) (3)

0% 25% 100%

Benchmark PBT per share (annual growth) 75% Below 4% 4% 8%

TSR of Experian vs TSR of FTSE 100 Index 25% Below Index Equal to Index 25% above Index

(1) Straight-line vesting between the points shown.

(2) Vesting of these awards will be subject to the Committee agreeing that ROCE performance is satisfactory and that vesting is not based on financial results which

have been materially misstated. In addition, the Committee has the discretion to vary the level of vesting if it considers that the level of vesting determined by

measuring performance is inconsistent with the Group’s underlying financial and operational performance.

(3) Under the clawback provisions, the Company may recover part or all of any vested award, at any time during the 12 months following the end of the performance period.

The Committee selected these financial measures as performance metrics as they reflect three of our key performance indicators (EBIT,

operating cash flow and ROCE). As described in the Chairman’s introduction and highlights, the Benchmark PBT metric has been

amended slightly and will now be measured on a per share basis. Whilst continuing to encourage profit growth this will also reinforce the

discipline of balancing growth investments against the value of returning capital to shareholders and therefore enhance the alignment of

management and shareholders’ interests.

The use of the financial metrics provides a direct link to the strategic aims of the business. The use of TSR recognises the importance of

returning value to shareholders.

92 Report on directors’ remuneration

Annual report on remuneration

continued

•Governance