Dollar General 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 55

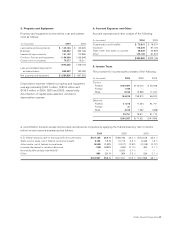

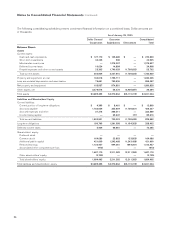

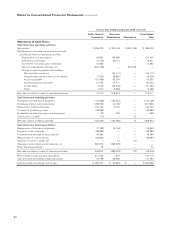

14. Quarterly Financial Data (Unaudited)

The following is selected unaudited quarterly financial data for the fiscal years ended January 28, 2005 and January 30,

2004. Each quarter listed below was a 13-week accounting period. Amounts are in thousands except per share data.

Quarter First Second Third Fourth

2004:

Net sales $1,747,959 $1,836,243 $1,879,187 $2,197,538

Gross profit 512,250 536,980 553,985 659,977

Net income 67,849 71,322 71,126 133,893

Diluted earnings per share $ 0.20 $ 0.22 $ 0.22 $ 0.41

Basic earnings per share $ 0.20 $ 0.22 $ 0.22 $ 0.41

2003:

Net sales $1,569,064 $1,651,094 $1,685,346 $1,966,488

Gross profit 451,906 472,830 516,897 576,496

Net income 60,332 59,936 77,903 100,831

Diluted earnings per share $ 0.18 $ 0.18 $ 0.23 $ 0.30

Basic earnings per share $ 0.18 $ 0.18 $ 0.23 $ 0.30

The second quarter 2004 net income and related per share amounts above include a favorable income tax adjustment of

approximately $6.2 million which resulted from net reductions in certain contingent income tax liabilities. The fourth quar-

ter 2003 net income and related per share amounts above include the accrual of a non-deductible civil penalty of $10.0

million related to the preliminary settlement of an SEC investigation (see Note 8). As discussed in Note 2, the Company

restated its financial statements, reducing its previously reported 2003 net income by $2.0 million, which is reflected in

the fourth quarter above. The third quarter 2003 net income and related per share amounts above include a favorable,

non-recurring pre-tax inventory adjustment of approximately $7.8 million based upon the utilization of information provided

by the Company’s new item level perpetual inventory system.

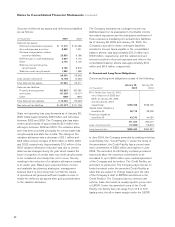

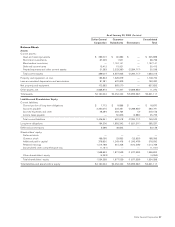

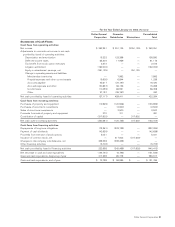

15. Guarantor Subsidiaries

All of the Company’s subsidiaries, except for its not-for-profit subsidiary whose assets and revenues are not material,

(the “Guarantors”) have fully and unconditionally guaranteed on a joint and several basis the Company’s obligations

under certain outstanding debt obligations. Each of the Guarantors is a direct or indirect wholly-owned subsidiary of the

Company. In order to participate as a subsidiary guarantor on certain of the Company’s financing arrangements, a sub-

sidiary of the Company has entered into a letter agreement with certain state regulatory agencies to maintain a minimum

balance of stockholders’ equity of $50 million in excess of the Company’s debt it has guaranteed, or $500 million as of

January 28, 2005. The subsidiary of the Company was in compliance with such agreement as of January 28, 2005.