Dollar General 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

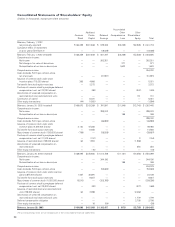

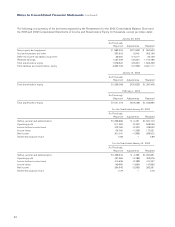

Consolidated Statements of Shareholders’ Equity

(Dollarsinthousands,exceptpershareamounts)

Common

Stock

Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Loss

Other

Shareholders’

Equity Total

Balances, February 1, 2002

(as previously reported) $166,359 $301,848 $ 579,265 $(3,228) $(2,526) $ 1,041,718

Cumulative effect of restatement

on prior years (See Note 2) — — (18,028) — — (18,028)

Balances, February 1, 2002 (restated) $166,359 $301,848 $ 561,237 $(3,228) $(2,526) $ 1,023,690

Comprehensive income:

Net income — — 262,351 — — 262,351

Net change in fair value of derivatives — — — 277 — 277

Reclassification of net loss on derivatives — — — 1,602 — 1,602

Comprehensive income 264,230

Cash dividends, $0.13 per common share,

net of accruals — — (31,991) — — (31,991)

Issuance of common stock under stock

incentive plans (710,000 shares) 355 4,666 — — — 5,021

Tax benefit from stock option exercises — 2,372 — — — 2,372

Purchase of common stock by employee deferred

compensation trust, net (27,000 shares) — (98) — — (347) (445)

Amortization of unearned compensation on

restricted stock and restricted stock units — — — — 131 131

Contribution of capital — 6,031 — — — 6,031

Other equity transactions (44) (1,550) — — — (1,594)

Balances, January 31, 2003 (restated) $166,670 $313,269 $ 791,597 $ (1,349) $ (2,742) $ 1,267,445

Comprehensive income:

Net income — — 299,002 — — 299,002

Reclassification of net loss on derivatives — — — 188 — 188

Comprehensive income 299,190

Cash dividends, $0.14 per common share — — (46,883) — — (46,883)

Issuance of common stock under stock

incentive plans (4,240,000 shares) 2,120 47,365 — — — 49,485

Tax benefit from stock option exercises — 14,565 — — — 14,565

Repurchases of common stock (1,519,000 shares) (759) — (28,928) — — (29,687)

Purchase of common stock by employee deferred

compensation trust, net (11,000 shares) — (157) — — 3 (154)

Issuance of restricted stock (129,000 shares) 64 1,904 — — (1,968) —

Amortization of unearned compensation on

restricted stock — — — — 354 354

Other equity transactions — (16) — — — (16)

Balances, January 30, 2004 (restated) $168,095 $376,930 $ 1,014,788 $ (1,161) $(4,353) $ 1,554,299

Comprehensive income:

Net income — — 344,190 — — 344,190

Reclassification of net loss on derivatives — — — 188 — 188

Comprehensive income 344,378

Cash dividends, $0.16 per common share — — (52,682) — — (52,682)

Issuance of common stock under stock incentive

plans (2,875,000 shares) 1,437 32,691 — — — 34,128

Tax benefit from stock option exercises — 9,657 — — — 9,657

Repurchases of common stock (11,020,000 shares) (5,510) — (203,785) — — (209,295)

Purchase of common stock by employee deferred

compensation trust, net (25,000 shares) — (92) — — (377) (469)

Issuance of restricted stock and restricted stock

units (128,000 shares) 64 2,398 — — (2,462) —

Amortization of unearned compensation on

restricted stock and restricted stock units — — — — 1,779 1,779

Deferred compensation obligation — — — 2,708 2,708

Other equity transactions — 16 (54) — — (38)

Balances, January 28, 2005 $164,086 $421,600 $ 1,102,457 $ (973) $(2,705) $ 1,684,465

The accompanying notes are an integral part of the consolidated financial statements.