Dollar General 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Notes to Consolidated Financial Statements (continued)

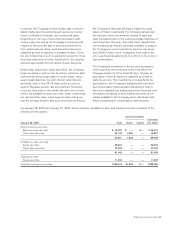

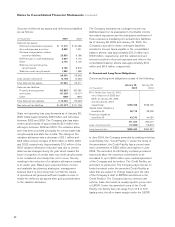

Sources of deferred tax assets and deferred tax liabilities

are as follows:

(In thousands) 2004 2003

Deferred tax assets:

Deferred compensation expense $ 17,310 $ 20,466

Accrued expenses and other 8,889 7,521

Workers compensation-related

insurance liabilities 25,950 9,198

Deferred gain on sale/leasebacks 2,624 2,775

Other 3,755 4,105

State tax net operating loss

carryforwards 9,180 9,916

State tax credit carryforwards 1,982 1,568

69,690 55,549

Less valuation allowance (2,126) (2,232)

Total deferred tax assets 67,564 53,317

Deferred tax liabilities:

Property and equipment (82,807) (60,091)

Inventories (31,635) (14,017)

Other (599) (935)

Total deferred tax liabilities (115,041) (75,043)

Net deferred tax liabilities $ (47,477) $ (21,726)

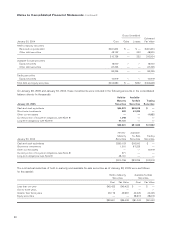

State net operating loss carryforwards as of January 28,

2005 totaled approximately $223 million and will expire

between 2005 and 2024. The Company also has state

credit carryforwards of approximately $3.0 million that

will expire between 2006 and 2016. The valuation allow-

ance has been provided principally for certain state loss

carryforwards and state tax credits. The change in the

valuation allowance was a decrease of $0.1 million and

$0.6 million and an increase of $0.5 million in 2004, 2003,

and 2002, respectively. Approximately $1.0 million of the

2003 valuation allowance reduction was due to certain

state tax law changes during the year which caused the

future recognition of certain state tax credit carryforwards

to be considered more likely than not to occur, thereby

resulting in the reduction of a valuation allowance created

in an earlier year. Based upon expected future income

and available tax planning strategies, management

believes that it is more likely than not that the results

of operations will generate sufficient taxable income to

realize the deferred tax assets after giving consideration

to the valuation allowance.

The Company estimates its contingent income tax

liabilities based on its assessment of probable income

tax-related exposures and the anticipated settlement of

those exposures translating into actual future liabilities.

As of January 28, 2005 and January 30, 2004, the

Company’s accrual for these contingent liabilities,

included in Income taxes payable in the consolidated

balance sheets, was approximately $13.5 million and

$16.9 million, respectively, and the related accrued

interest included in Accrued expenses and other in the

consolidated balance sheets was approximately $6.9

million and $6.6 million, respectively.

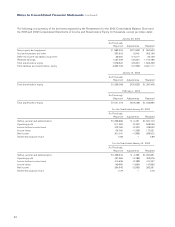

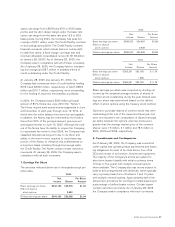

6. Current and Long-Term Obligations

Current and long-term obligations consist of the following:

(In thousands)

January 28,

2005

January 30,

2004

85⁄8% Notes due June 15, 2010,

net of discount of $232 and

$275, at January 28, 2005

and January 30, 2004,

respectively $199,768 $199,725

Capital lease obligations

(see Note 8) 28,178 38,228

Financing obligations

(see Note 8) 43,376 44,054

271,322 282,007

Less: current portion (12,860) (16,670)

Long-term portion $258,462 $265,337

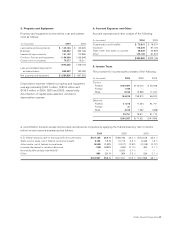

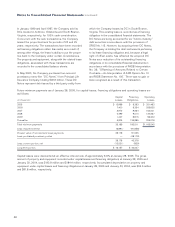

In June 2004, the Company amended its existing revolving

credit facility (the “Credit Facility”). Under the terms of

the amendment, the Credit Facility has a current maxi-

mum commitment of $250 million and expires in June

2009. The amended Credit Facility contains provisions

that would allow the maximum commitment to be

increased to up to $400 million upon mutual agreement

of the Company and its lenders. The Credit Facility, as

amended, is unsecured. The Company pays interest on

funds borrowed under the amended Credit Facility at

rates that are subject to change based upon the ratio

of the Company’s debt to EBITDA (as defined in the

Credit Facility). The Company has two interest rate

options, base rate (which is usually equal to prime rate)

or LIBOR. Under the amended terms of the Credit

Facility, the facility fees can range from 12.5 to 37.5

basis points; the all-in drawn margin under the LIBOR