Dollar General 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 47

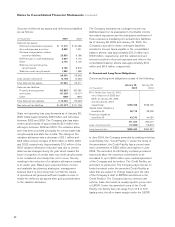

option can range from LIBOR plus 87.5 to 212.5 basis

points; and the all-in drawn margin under the base rate

option can range from the base rate plus 12.5 to 62.5

basis points. During 2004, the Company had peak bor-

rowings of $73.1 million under the Credit Facility, and had

no borrowings during 2003. The Credit Facility contains

financial covenants, which include limits on certain debt

to cash flow ratios, a fixed charge coverage test and

minimum allowable consolidated net worth ($1.39 billion

at January 28, 2005). As of January 28, 2005, the

Company was in compliance with all of these covenants.

As of January 28, 2005, the Company had no outstand-

ing borrowings and $8.7 million of standby letters of

credit outstanding under the Credit Facility.

At January 28, 2005 and January 30, 2004, the

Company had commercial letter of credit facilities totaling

$215.0 and $218.0 million, respectively, of which $98.8

million and $111.7 million, respectively, were outstanding

for the funding of imported merchandise purchases.

In 2000, the Company issued $200 million principal

amount of 85⁄8% Notes due June 2010 (the “Notes”).

The Notes require semi-annual interest payments in June

and December of each year through June 15, 2010, at

which time the entire balance becomes due and payable.

In addition, the Notes may be redeemed by the holders

thereof at 100% of the principal amount, plus accrued

and unpaid interest on June 15, 2005. Although the hold-

ers of the Notes have the ability to require the Company

to repurchase the notes in June 2005, the Company has

classified this debt as long-term due to its intent and

ability, in the event it were required to repurchase any

portion of the Notes, to refinance this indebtedness on

a long-term basis, including through borrowings under

the Credit Facility. The Notes contain certain restrictive

covenants. At January 28, 2005, the Company was in

compliance with all such covenants.

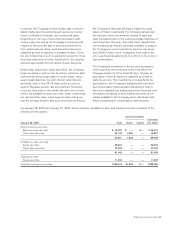

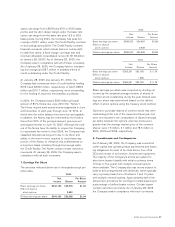

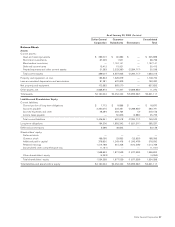

7. Earnings Per Share

The amounts reflected below are in thousands except per

share data.

2004

Net

Income Shares

Per Share

Amount

Basic earnings per share $344,190 329,376 $1.04

Effect of dilutive

stock options 2,692

Diluted earnings per share $344,190 332,068 $1.04

2003

Net

Income Shares

Per Share

Amount

Basic earnings per share $299,002 334,697 $0.89

Effect of dilutive

stock options 2,939

Diluted earnings per share $299,002 337,636 $0.89

2002

Net

Income Shares

Per Share

Amount

Basic earnings per share $262,351 333,055 $ 0.79

Effect of dilutive

stock options 1,995

Diluted earnings per share $262,351 335,050 $ 0.78

Basic earnings per share was computed by dividing net

income by the weighted average number of shares of

common stock outstanding during the year. Diluted earn-

ings per share was determined based on the dilutive

effect of stock options using the treasury stock method.

Options to purchase shares of common stock that were

outstanding at the end of the respective fiscal year, but

were not included in the computation of diluted earnings

per share because the options’ exercise prices were

greater than the average market price of the common

shares, were 7.3 million, 5.1 million and 18.3 million in

2004, 2003 and 2002, respectively.

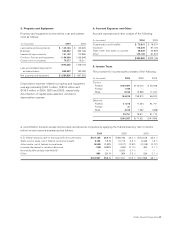

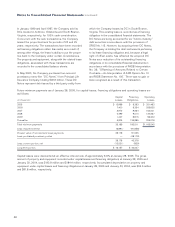

8. Commitments and Contingencies

As of January 28, 2005, the Company was committed

under capital and operating lease agreements and financ-

ing obligations for most of its retail stores, four of its

DCs and certain of its furniture, fixtures and equipment.

The majority of the Company’s stores are subject to

short-term leases (usually with initial or primary terms

of three to five years) with multiple renewal options

when available. The Company also has stores subject to

build-to-suit arrangements with landlords, which typically

carry a primary lease term of between 7 and 10 years

with multiple renewal options. Approximately half of the

stores have provisions for contingent rentals based upon

a percentage of defined sales volume. Certain leases

contain restrictive covenants. As of January 28, 2005,

the Company was in compliance with such covenants.