Dollar General 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 45

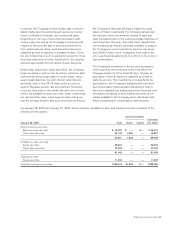

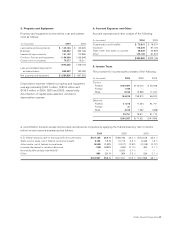

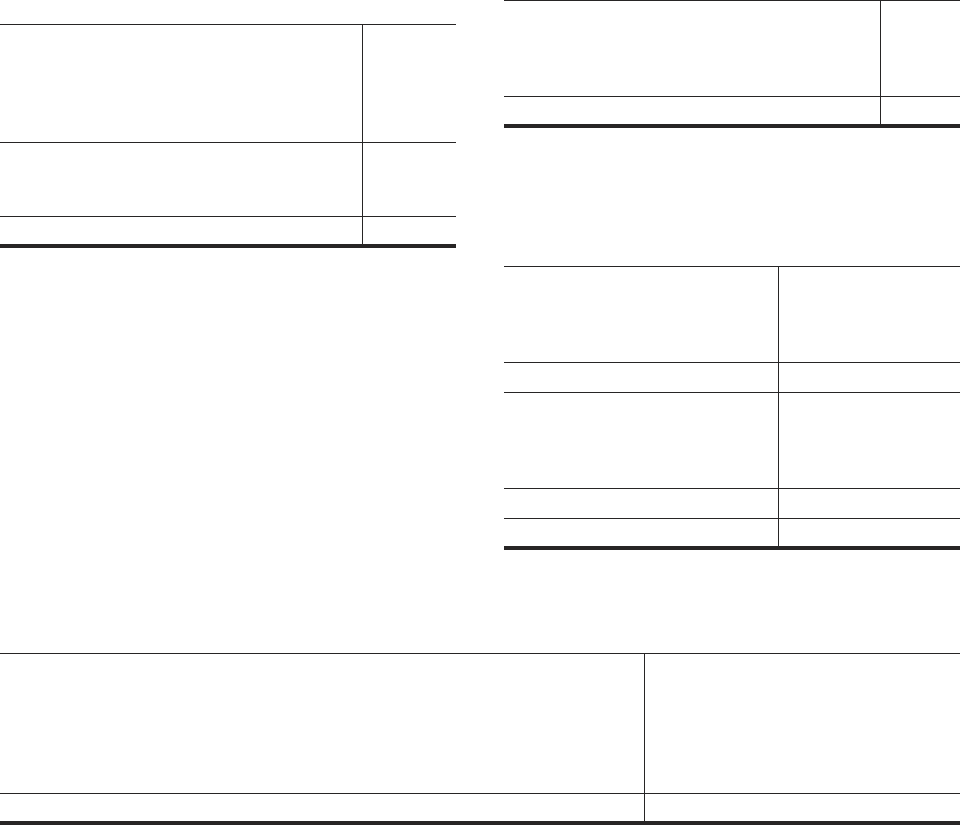

3. Property and Equipment

Property and equipment is recorded at cost and summa-

rized as follows:

(In thousands) 2004 2003

Land and land improvements $ 145,194 $ 145,605

Buildings 333,667 333,765

Leasehold improvements 191,103 170,895

Furniture, fixtures and equipment 1,196,094 1,039,946

Construction in progress 74,277 19,511

1,940,335 1,709,722

Less accumulated depreciation

and amortization 859,497 752,090

Net property and equipment $ 1,080,838 $ 957,632

Depreciation expense related to property and equipment

was approximately $163.1 million, $150.9 million and

$139.0 million in 2004, 2003 and 2002, respectively.

Amortization of capital lease assets is included in

depreciation expense.

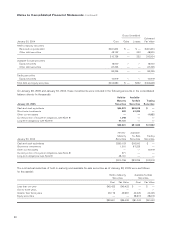

4. Accrued Expenses and Other

Accrued expenses and other consist of the following:

(In thousands) 2004 2003

Compensation and benefits $ 72,815 $ 78,374

Insurance 118,326 97,104

Taxes (other than taxes on income) 39,639 35,859

Other 103,109 91,819

$ 333,889 $ 303,156

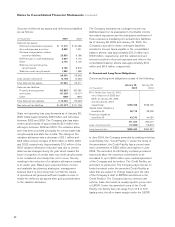

5. Income Taxes

The provision for income taxes consists of the following:

(In thousands) 2004 2003 2002

Current:

Federal $155,497 $145,072 $ 55,646

Foreign 1,169 — —

State 8,150 13,838 11,167

164,816 158,910 66,813

Deferred:

Federal 21,515 17,224 81,741

Foreign 21 — —

State 4,215 1,387 (568)

25,751 18,611 81,173

$190,567 $177,521 $147,986

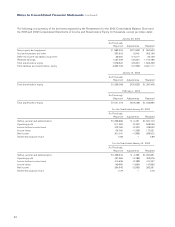

A reconciliation between actual income taxes and amounts computed by applying the federal statutory rate to income

before income taxes is summarized as follows:

2004 2003 2002

U.S. federal statutory rate on earnings before income taxes $187,165 35.0 % $166,783 35.0 % $143,618 35.0 %

State income taxes, net of federal income tax benefit 8,168 1.5 % 10,773 2.3 % 6,426 1.6 %

Jobs credits, net of federal income taxes (5,544) (1.0)% (3,817) (0.8)% (2,745) (0.7)%

Increase (decrease) in valuation allowance (106) (0.0)% (582) (0.1)% 463 0.1 %

Non-deductible penalty (see Note 8) — — 3,500 0.7 % — —

Other 884 0.1 % 864 0.2 % 224 0.1 %

$190,567 35.6 % $177,521 37.3 % $147,986 36.1 %