Dollar General 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

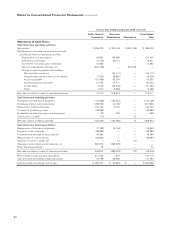

Notes to Consolidated Financial Statements (continued)

Notice was sent to prospective class members and the

deadline for individuals to opt in to the lawsuit was May 31,

2004. Approximately 5,000 individuals opted in. The Court

has entered a scheduling order that governs the discovery

and remaining phases of the case.

Three additional lawsuits, Tina Depasquales v. Dollar

General Corp. (Southern District of Georgia, Savannah

Division, CV 404-096, filed May 12, 2004), Karen

Buckley v. Dollar General Corp. (Southern District of

Ohio, C-2-04-484, filed June 8, 2004), and Sheila Ann

Hunsucker v. Dollar General Corp. et al. (Western

District of Oklahoma, Civ-04-165-R, filed February 19,

2004), were filed asserting essentially the same claims

as the Brown case, all of which have since been consoli-

dated in the Northern District of Alabama where the

Brown litigation is pending. The Company believes that

the consolidation will not affect the scheduling order or

extend any of the deadlines in the Brown case.

The Company believes that its store managers are and

have been properly classified as exempt employees

under the FLSA and that the action is not appropriate

for collective action treatment. The Company intends to

vigorously defend the action. However, no assurances

can be given that the Company will be successful in

defending this action on the merits or otherwise; and, if

not, the resolution could have a material adverse effect

on the Company’s financial statements as a whole.

The Company is involved in other legal actions and claims

arising in the ordinary course of business. The Company

currently believes that such other litigation and claims,

both individually and in the aggregate, will be resolved

without a material effect on the Company’s financial

statements as a whole. However, litigation involves an

element of uncertainty. Future developments could cause

these actions or claims to have a material adverse effect

on the Company’s financial statements as a whole.

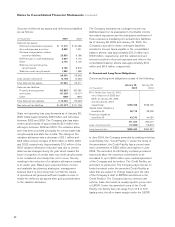

9. Benefit Plans

Effective January 1, 1998, the Company established a

401(k) savings and retirement plan. Balances in two

earlier plans were transferred into this plan. All employees

who had completed 12 months of service, worked 1,000

hours per year, and were at least 21 years of age were

eligible to participate in the plan. Employee contributions,

up to 6% of annual compensation, were matched by the

Company at the rate of $0.50 on the dollar. The Company

also contributed a discretionary amount annually to the

plan equal to 2% of each employee’s annual compensation.

Effective January 1, 2003, the plan was amended to

allow all eligible employees to participate in the plan and

to contribute up to 25% of annual compensation from

their date of hire up to a maximum of $12,000 in calendar

year 2003 and a maximum of $13,000 in calendar year

2004; the Company match of employee contributions

was changed to a rate of $1.00 for each $1.00 contrib-

uted up to 5% of annual salary (upon completion of 12

months and a minimum of 1,000 hours of service); and

the Company’s discretionary annual contribution to the

plan of 2% of annual compensation was eliminated.

Effective January 1, 2005, the plan was amended to

allow for catch-up employee contributions and to clarify

certain provisions. All active employees are fully vested

in all contributions to the plan. Expense for the plan was

approximately $4.9 million in 2004, $2.7 million in 2003

and $5.9 million in 2002.

Effective January 1, 1998, the Company also established

a supplemental retirement plan and a compensation

deferral plan for a select group of management and highly

compensated employees. The supplemental retirement

plan is a non-contributory defined contribution plan with

annual Company contributions ranging from 2% to 12%

of base pay plus bonus depending upon age plus years

of service and job grade. Under the compensation defer-

ral plan, participants may defer up to 65% of base pay

(reduced by any deferrals to the 401(k) Plan) and up to

100% of bonus pay, and the Company matches base pay

deferrals at a rate of 100% of base pay deferral, up to

5% of annual salary, offset by the amount of match in the

401(k) Plan. Effective January 1, 2000, both the supple-

mental retirement plan and compensation deferral plan

were amended and restated so that such plans were

combined into one master plan document. Effective

January 1, 2003, the plan document was amended to

clarify certain provisions and to mirror the 401(k) plan

employer contribution provisions that became effective

on January 1, 2003, as described above. Effective

November 1, 2004, the plan document was amended to

modify eligibility, comply with pending federal legislation,

and enhance investment offerings. An employee may be

designated for participation in one or both of the plans,

according to the eligibility requirements of the plans.

All participants are 100% vested in their compensation

deferral plan accounts. Supplemental retirement plan

accounts generally vest at the earlier of the participant’s

attainment of age 50 or the participant’s being credited