Dollar General 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 49

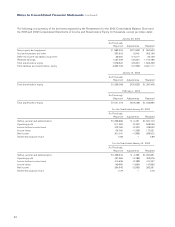

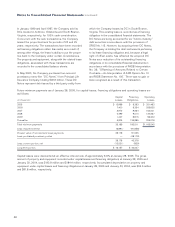

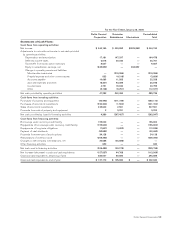

Rent expense under all operating leases was as follows:

(In thousands) 2004 2003 2002

Minimum rentals $253,364 $217,704 $187,568

Contingent rentals 15,417 14,302 15,500

$268,781 $232,006 $203,068

Legal proceedings

Restatement-relatedproceedings. As previously

disclosed in the Company’s periodic reports filed with

the SEC, the Company restated its audited financial

statements for fiscal years 1999 and 1998, and certain

unaudited financial information for fiscal year 2000, by

means of its Form 10-K for the fiscal year ended

February 2, 2001, which was filed on January 14,

2002 (the “2001 Restatement”).

The SEC conducted an investigation into the circum-

stances giving rise to the 2001 Restatement and, on

January 8, 2004, the Company received notice that the

SEC staff was considering recommending that the SEC

bring a civil injunctive action against the Company for

alleged violations of the federal securities laws in connec-

tion with circumstances relating to the restatement. The

Company subsequently reached an agreement in princi-

ple with the SEC staff to settle the matter. Under the

terms of the agreement in principle, the Company, with-

out admitting or denying the allegations in a complaint to

be filed by the SEC, will consent to the entry of a perma-

nent civil injunction against future violations of the anti-

fraud, books and records, reporting and internal control

provisions of the federal securities laws and related SEC

rules and will pay a $10 million non-deductible civil pen-

alty. The Company is not entitled to seek reimbursement

from its insurers with regard to this settlement.

The Company has been informed that the SEC approved

the agreement and intends to file its Complaint and the

proposed Final Judgment and Consent and Undertakings

of Dollar General Corporation with the United States

District Court for the Middle District of Tennessee. The

agreement and order are subject to final approval by the

Court. The Company accrued $10 million with respect to

the penalty in its financial statements for the year ended

January 30, 2004, and this accrual remains outstanding

as of January 28, 2005. The Company can give no assur-

ances that the Court will approve this agreement and

order. If the agreement and order are not approved, the

Company could be subject to different or additional pen-

alties, both monetary and non-monetary, which could

materially and adversely affect the Company’s financial

statements as a whole.

In addition, as previously discussed in the Company’s

periodic reports filed with the SEC, the Company settled

in the second quarter of 2002 the lead shareholder deriva-

tive action relating to the 2001 Restatement that had been

filed in Tennessee State Court. All other pending state and

federal derivative cases were subsequently dismissed

during the third quarter of fiscal 2002. The settlement of

the shareholder derivative lawsuits resulted in a net pay-

ment to the Company, after attorney’s fees payable to the

plaintiffs’ counsel, of approximately $25.2 million, which

was recorded as income during the third quarter of 2002.

The Company also settled the federal consolidated 2001

Restatement-related class action lawsuit in the second

quarter of fiscal 2002. The $162 million settlement, which

was expensed in the fourth quarter of 2000, was paid in

the first half of fiscal 2002. The Company received from

its insurers $4.5 million in respect of such settlement in

July 2002, which was recorded as income during the

second quarter of 2002.

Plaintiffs representing fewer than 1% of the shares

traded during the class period chose to opt out of the

federal class action settlement. One such plaintiff chose

to pursue recovery against the Company individually.

In 2002, the Company settled and paid that claim and

recognized an expense of $0.2 million in respect of

that agreement.

Otherlitigation. On March 14, 2002, a complaint was

filed in the United States District Court for the Northern

District of Alabama (Edith Brown, on behalf of herself

and others similarly situated v. Dolgencorp. Inc., and

Dollar General Corporation, CV02-C-0673-W (“Brown”))

to commence a collective action against the Company

on behalf of current and former salaried store managers.

The complaint alleges that these individuals were entitled

to overtime pay and should not have been classified

as exempt employees under the Fair Labor Standards

Act (“FLSA”). Plaintiffs seek to recover overtime pay,

liquidated damages, declaratory relief and attorneys’ fees.

On January 12, 2004, the court certified an opt-in class

of plaintiffs consisting of all persons employed by the

Company as store managers at any time since March 14,

1999, who regularly worked more than 50 hours per

week and either: (1) customarily supervised less than

two employees at one time; (2) lacked authority to hire or

discharge employees without supervisor approval; or (3)

sometimes worked in non-managerial positions at stores

other than the one he or she managed. The Company’s

attempt to appeal this decision on a discretionary basis

to the 11th Circuit Court of Appeals was denied.