Dollar General 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

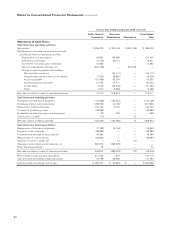

Notes to Consolidated Financial Statements (continued)

sum distribution of amounts credited to his account in

accordance with the terms of the directors’ deferral plan.

All deferred compensation will be immediately due and

payable upon a “change in control” (as defined in the

directors’ deferral plan) of the Company. Effective

January 1, 2005, account balances deemed to be

invested in the Mutual Fund Options are payable in cash

and account balances deemed to be invested in the

Common Stock Option are payable in shares of Dollar

General common stock and cash in lieu of fractional

shares. Prior to January 1, 2005, all account balances

were payable in cash.

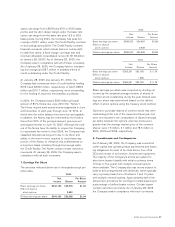

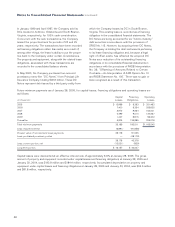

10. Stock-Based Compensation

The Company has a shareholder-approved stock incen-

tive plan under which restricted stock, restricted stock

units, stock options and other equity-based awards may

be granted to officers, directors and key employees.

All stock options granted in 2004, 2003 and 2002 under

the terms of the Company’s stock incentive plan were

non-qualified stock options issued at a price equal to

the fair market value of the Company’s common stock

on the date of grant. Non-qualified options granted under

these plans have expiration dates no later than 10 years

following the date of grant.

Under the plan, stock option grants are made to key

management employees including officers, as well as

other employees, as determined by the Compensation

Committee of the Board of Directors. The number of

options granted is directly linked to the employee’s job

classification. Beginning in 2002, vesting provisions for

options granted under the plan changed from a combina-

tion of Company performance-based vesting and time-

based vesting to time-based vesting only. All options

granted in 2004, 2003 and 2002 under the plan vest

ratably over a four-year period, except for a grant made

to the CEO in 2003, two-thirds of which vested after one

year and one-third of which vests after two years.

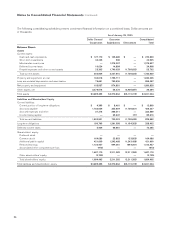

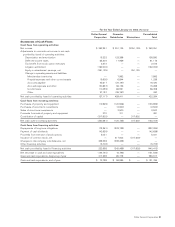

Under the plan, restricted stock and restricted stock

units (which represent the right to receive one share

of common stock for each unit upon vesting) may be

granted to employees, including officers, as determined

by the Compensation Committee of the Board of

Directors. In addition, the plan provides for the automatic

annual grant of 4,600 restricted stock units to each

non-employee director. In 2004 and 2003, the Company

awarded a total of 166,300 and 50,000 shares of

restricted stock and restricted stock units to certain plan

participants at a weighted average fair value of $19.26

and $19.37 per share, respectively. The difference

between the market price of the underlying stock on

the date of grant and the purchase price, which was set

at zero for all restricted stock and restricted stock unit

awards in 2004 and 2003, was recorded as unearned

compensation expense, which is a component of Other

shareholders’ equity, and is being amortized to expense

on a straight-line basis over the restriction period.

The restricted stock and restricted stock units granted

to employees in 2004 and 2003 under the plan vest and

become payable ratably over a three-year period. The

restricted stock units granted to outside directors gener-

ally vest one year after the grant date subject to acceler-

ation of vesting upon retirement or other circumstances

set forth in the plan, but no payout shall be made until

the individual has ceased to be a member of the Board

of Directors. Under the stock incentive plan, recipients

of restricted stock are entitled to receive cash dividends

and to vote their respective shares, but are prohibited

from selling or transferring restricted shares prior to

vesting. Recipients of restricted stock units are entitled

to accrue dividend equivalents on the units but are not

entitled to vote, sell or transfer the shares underlying

the units prior to both vesting and payout. The maximum

number of shares of restricted stock or restricted stock

units eligible for issuance under the terms of this plan

has been capped at 4,000,000. At January 28, 2005,

3,763,451 shares of restricted stock or restricted stock

units were available for grant under the plan.

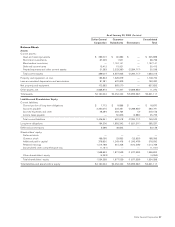

During 2003, the Company also granted stock options

and restricted stock in transactions that were not made

under the stock incentive plan. The Company awarded

78,865 shares of restricted stock as a material induce-

ment to employment to its CEO at a fair value of $12.68

per share. The difference between the market price of

the underlying stock and the purchase price on the date

of grant, which was set as zero for this restricted stock

award, was recorded as unearned compensation

expense, and is being amortized to expense on a

straight-line basis over the restriction period of five

years. The CEO is entitled to receive cash dividends

and to vote these shares, but is prohibited from selling or

transferring shares prior to vesting. Also during the first

quarter of 2003, the Company awarded the CEO, as a

material inducement to employment, an option to pur-

chase 500,000 shares at an exercise price of $12.68

per share. The option generally vests at a rate of 166,666

shares on the second anniversary of the grant date and

333,334 shares on the third anniversary of the grant date,