Dollar General 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dollar General Corporation 13

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

General

Accounting Periods. The following text contains

references to years 2005, 2004, 2003 and 2002, which

represent fiscal years ending or ended February 3, 2006,

January 28, 2005, January 30, 2004 and January 31,

2003, respectively. Fiscal year 2005 will be a 53-week

accounting period while 2004, 2003 and 2002 were

52-week accounting periods. The Company’s fiscal year

ends on the Friday closest to January 31. This discussion

and analysis should be read with, and is qualified in its

entirety by, the Consolidated Financial Statements and

the notes thereto.

Executive Overview. Fiscal 2004 was a significant

year of investment for the Company. Despite a difficult

economic environment for its customers, the Company

successfully implemented many of the important operat-

ing initiatives outlined in last year’s Form 10-K, while also

achieving improved financial results. The following are

some of the more significant operating accomplishments

during 2004:

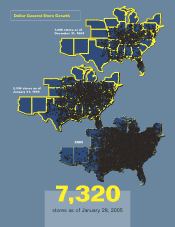

■ The opening of 722 new stores, including stores in

3 additional states;

■ The addition of coolers (which allow the Company’s

stores to carry perishable products) in the majority of

stores, bringing the total number of stores with coolers

to 6,755 at January 28, 2005. In addition, over 6,300

stores were certified and accepting electronic benefit

transfers (“EBT”);

■ The rollout of automatic inventory replenishment to all

stores, completed during the first quarter of 2004, and

the related improvement of inventory in-stock levels;

■ The rollout of the acceptance of the Discover card and

debit cards to all stores;

■ The design completion and initiation of implementation

of the “EZstore” project, which is designed to improve

many facets of inventory flow from distribution centers

to consumers and other areas of store operations,

including labor scheduling, hiring and training and

product presentation;

■ The ongoing construction of the Company’s eighth

distribution center in South Carolina and substantial

completion of expansion projects in 2 other distribution

facilities to increase overall distribution capacity;

■ The implementation of a merchandising data

warehouse;

■ The increased store manager training and reduction

of store manager turnover to under 50% in 2004.

In 2005, the Company will focus its efforts on

accomplishing the following operating initiatives:

■ Opening 730 new Dollar General stores, including

at least 30 new Dollar General Market stores, and

continuing to look westward for further geographical

expansion;

■ Continuing to invest in its EZstore project with the goal

of rolling it out to half of its stores by the end of 2005;

■ Reducing inventory levels on a per-store basis by

revisiting replenishment assumptions, safety stock

levels needed in distribution centers and improving

execution of selling through seasonal and other non-

core merchandise;

■ Continuing to test Dollar General Market store formats

and additional geographic areas for these stores;

■ Continuing to focus on hiring practices and instilling

increased accountability among the Company’s

employees;

■ Identifying a location for and commencing construction

on a ninth distribution center for a planned opening

during 2006.

The Company can provide no assurance that it will be

successful in executing these initiatives, nor can the

Company guarantee that the successful implementation

of these initiatives will result in superior financial

performance.

In addition to undertaking the operating initiatives

described above, the Company also intends to focus

on and evaluate the status of certain other issues.

Those issues are likely to include:

■ The appropriate level of share repurchases for 2005 (in

2004, the Company spent $209.3 million repurchasing

approximately 11 million shares);

■ The impact on the Company, if any, from recent or

potential legislation affecting minimum wages;

■ The impact of increasing fuel costs;

■ The impact of increasing health care and workers’

compensation costs;

■ The progress of the wage and hour collective action

litigation in the state of Alabama, discussed more fully

in Note 8 to the Consolidated Financial Statements;

■ The Company’s rating agency debt ratings.