Dollar General 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dollar General Corporation 29

Management’s Annual Report on Internal Control Over Financial Reporting

Management of the Company is responsible for estab-

lishing and maintaining effective internal control over

financial reporting as defined in Rules 13a-15(f) under the

Securities Exchange Act of 1934. The Company’s internal

control over financial reporting is designed to provide

reasonable assurance that the controls and procedures

will meet their objectives regarding the preparation and

fair presentation of published financial statements.

Because of its inherent limitations, internal control over

financial reporting may not prevent or detect misstate-

ments. Therefore, even those systems determined to

be effective can provide only reasonable assurance

with respect to financial statement preparation and

presentation.

Management assessed the effectiveness of the

Company’s internal control over financial reporting as

of January 28, 2005. In making this assessment, man-

agement used the criteria set forth by the Committee of

Sponsoring Organizations of the Treadway Commission

(COSO) in Internal Control-Integrated Framework.

The assessment identified a material weakness in the

Company’s internal control that arose from the

Company’s inappropriate interpretation of GAAP relating

to accounting for leases and leasehold improvements,

as described more fully below. A material weakness is a

control deficiency, or combination of control deficiencies,

that results in more than a remote likelihood that a

material misstatement of the annual or interim financial

statements will not be prevented or detected.

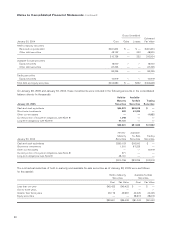

As more fully discussed in Note 2 to the Consolidated

Financial Statements, the Company restated its previ-

ously issued financial statements as a result of correcting

its accounting practices relating to the amortization of

certain leasehold improvements and the recognition of

rent expense. The restatement was technically required

even though the adjustments for each individual year are

not material to that year’s previously reported results and

have no impact on the Company’s current or future cash

flows. Near the end of its fiscal year, after reviewing

numerous press releases issued by other companies and

other public comments pertaining to these topics and

after discussing the matter with its external auditors, the

Company undertook a new review of its operating lease

accounting and leasehold amortization practices. This

review, together with the views on the matters expressed

by the SEC in a February 7, 2005 letter to the Chairman

of the AICPA Center for Public Company Audit Firms, led

to the Company’s conclusion that its historical accounting

practices in these areas were not in accordance with

GAAP. These historical practices were specifically

reviewed on several occasions in the past by the

Company’s management, external auditors and Audit

Committee of the Board of Directors. In addition, the

Company’s practices were similar to those used by many

other retail and restaurant companies. Although the

Company corrected these errors prior to the filing of its

Form 10-K for the 2004 fiscal year, thus remediating its

only material weakness, they were not effectively remedi-

ated prior to January 28, 2005. Accordingly, the Company

concluded that it had a material weakness, namely the

incorrect interpretation and application of GAAP relating

to the two lease-related matters discussed above.

Based on management’s assessment, management

concluded that, as of January 28, 2005, due solely to the

material weakness related to the accounting for leases

and leasehold improvements, the Company’s internal

control over financial reporting was not effective.

Management’s assessment of the effectiveness of internal

control over financial reporting as of January 28, 2005,

has been audited by Ernst & Young LLP, the independent

registered public accounting firm who also audited the

Company’s consolidated financial statements. Ernst &

Young’s attestation report on management’s assessment

of the Company’s internal control over financial reporting

is contained below.