Dollar General 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar General Corporation 53

subject to accelerated vesting as provided in Mr. Perdue’s

Employment Agreement or in the plan. The option will

terminate no later than 10 years from the grant date.

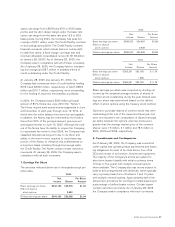

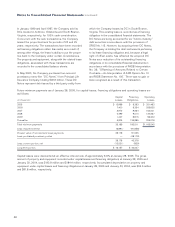

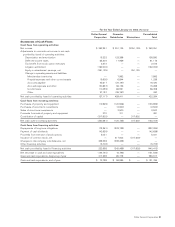

Pro forma information regarding net income and earnings

per share, as disclosed in Note 1, has been determined

as if the Company had accounted for its employee stock-

based compensation plans under the fair value method of

SFAS No. 123. The fair value of options granted during

2004, 2003 and 2002 was $6.36, $5.45 and $6.15,

respectively. The fair value of each stock option grant was

estimated on the date of grant using the Black-Scholes

option-pricing model with the following assumptions:

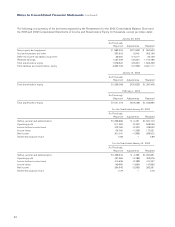

2004 2003 2002

Expected dividend yield 0.9% 0.9% 0.8%

Expected stock price volatility 35.5% 36.9% 35.3%

Weighted average risk-free

interest rate 3.5% 2.7% 3.9%

Expected life of options (years) 5.0 3.7 6.5

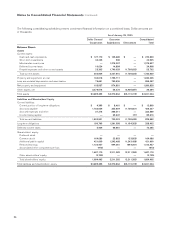

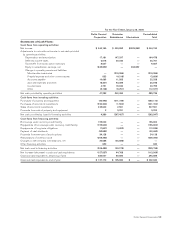

A summary of the balances and activity for all of the

Company’s stock option awards for the last three fiscal

years is presented below:

Shares

Issued

Weighted

Average

Exercise

Price

Balance, February 1, 2002 25,970,762 $15.65

Granted 4,146,986 15.83

Exercised (690,515) 6.90

Canceled (2,510,662) 17.35

Balance, January 31, 2003 26,916,571 15.73

Granted 4,705,586 18.39

Exercised (4,240,438) 11.68

Canceled (2,450,429) 17.76

Balance, January 30, 2004 24,931,290 16.75

Granted 2,250,900 18.88

Exercised (2,874,828) 11.87

Canceled (1,758,030) 18.97

Balance, January 28, 2005 22,549,332 $17.42

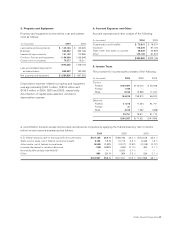

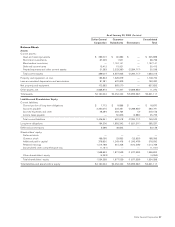

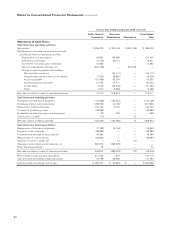

The following table summarizes information about all stock options outstanding at January 28, 2005:

Options Outstanding Options Exercisable

Range of

Exercise Prices

Number

Outstanding

Weighted

Average

Remaining

Contractual Life

Weighted

Average

Exercise

Price

Number

Exercisable

Weighted

Average

Exercise

Price

$ 4.27–$10.68 1,107,229 1.8 $ 6.83 1,051,419 $ 6.74

$10.73–$17.31 9,268,565 5.9 14.86 6,060,665 14.90

$17.64–$23.90 12,173,538 6.4 20.33 6,724,375 20.78

$ 4.27–$23.90 22,549,332 6.0 $17.42 13,836,459 $17.14

At January 28, 2005, there were approximately 8.3 million shares available for grant under the Company’s stock incentive

plan. At January 30, 2004 and January 31, 2003, respectively, there were approximately 15.0 million and 17.0 million

exercisable options outstanding.

11. Capital Stock

The Company has a Shareholder Rights Plan (the “Plan”)

under which Series B Junior Participating Preferred

Stock Purchase Rights (the “Rights”) were issued for

each outstanding share of common stock. The Rights

were attached to all common stock outstanding as of

March 10, 2000, and will be attached to all additional

shares of common stock issued prior to the Plan’s

expiration on February 28, 2010, or such earlier termination,

if applicable. The Rights entitle the holders to purchase

from the Company one one-hundredth of a share (a

“Unit”) of Series B Junior Participating Preferred Stock

(the “Preferred Stock”), no par value, at a purchase

price of $100 per Unit, subject to adjustment. Initially, the

Rights will attach to all certificates representing shares

of outstanding common stock, and no separate Rights

Certificates will be distributed. The Rights will become

exercisable upon the occurrence of a triggering event as

defined in the Plan.