Dollar General 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

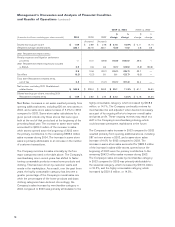

Management’s Discussion and Analysis of Financial Condition

and Results of Operations (continued)

Accounting Pronouncements

In December 2004, the Financial Accounting Standards

Board (“FASB”) issued Statement of Financial Accounting

Standards (“SFAS”) No. 123R, “Share-Based Payment,”

which will require all companies to measure compensation

cost for all share-based payments (including employee

stock options) at fair value. This new standard will be

effective for public companies for interim or annual peri-

ods beginning after June 15, 2005. Companies can adopt

the new standard in one of two ways: (i) the modified pro-

spective application, in which a company would recognize

share-based employee compensation cost from the

beginning of the fiscal period in which the recognition

provisions are first applied as if the fair-value-based

accounting method had been used to account for all

employee awards granted, modified or settled after the

effective date and to any awards that were not fully

vested as of the effective date; or (ii) the modified retro-

spective application, in which a company would recognize

employee compensation cost for periods presented prior

to the adoption of SFAS No. 123R in accordance with

the original provisions of SFAS No. 123, “Accounting for

Stock-Based Compensation,” pursuant to which an entity

would recognize employee compensation cost in the

amounts reported in the pro forma disclosures provided

in accordance with SFAS No. 123. The Company expects

to adopt SFAS No. 123R during the third quarter of 2005

using the modified prospective application, and expects

to incur incremental SG&A expense associated with the

adoption of approximately $4 million to $8 million in 2005.

See Note 1 to the Consolidated Financial Statements for

disclosure of the pro forma effects of stock option grants

as determined using the methodology prescribed under

SFAS No. 123.

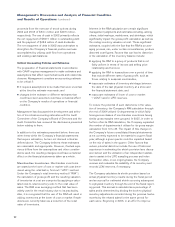

Forward Looking Statements/Risk Factors

Except for specific historical information, many of the

matters discussed in this report and in the documents

incorporated by reference into this report may express or

imply projections of revenues or expenditures, statements

of plans and objectives for future operations, growth or

initiatives, statements of future economic performance

or statements regarding the outcome or impact of pend-

ing or threatened litigation. These and similar statements

regarding events or results which the Company expects

will or may occur in the future are forward-looking

statements concerning matters that involve risks,

uncertainties and other factors which may cause the

actual performance of the Company to differ materially

from those expressed or implied by these statements.

All forward-looking information should be evaluated in

the context of these risks, uncertainties and other fac-

tors. The words “believe,” “anticipate,” “project,” “plan,”

“expect,” “estimate,” “objective,” “forecast,” “goal,”

“intend,” “will likely result” or “will continue” and similar

expressions generally identify forward-looking statements.

The Company believes the assumptions underlying these

forward-looking statements are reasonable; however, any

of the assumptions could be inaccurate, and therefore,

actual results may differ materially from those projected

in the forward-looking statements. Factors and risks that

may result in actual results differing from such forward-

looking information include, but are not limited to, those

listed below, as well as other factors discussed throughout

this document, including without limitation the factors

described under “Critical Accounting Policies and Estimates.”

TheCompany’sbusinessismoderatelyseasonalwith

thehighestsalesoccurringduringthefourthquarter.

Adverseeventsduringthefourthquartercould,there-

fore,affecttheCompany’sfinancialstatementsasa

whole. The Company realizes a significant portion of

its net sales and net income during the holiday selling

season. In anticipation of the holidays, the Company

purchases substantial amounts of seasonal inventory

and hires many temporary employees. If for any reason

the Company’s net sales during the holiday selling sea-

son were to fall below seasonal norms, a seasonal mer-

chandise inventory imbalance could result. If such an

imbalance were to occur, markdowns might be required

to minimize this imbalance. The Company’s profitability

and operating results could be adversely affected by

unanticipated markdowns.

Adverse weather conditions or other disruptions,

especially during the peak holiday season but also at

other times, could also adversely affect the Company’s

net sales and could make it more difficult for the

Company to obtain sufficient quantities of merchandise

from its suppliers.

Competitionintheretailindustrycouldlimitthe

Company’sgrowthopportunitiesandreduceitsprofit-

ability. The Company competes in the discount retail

merchandise business, which is highly competitive.

This competitive environment subjects the Company to

the risk of reduced profitability resulting from reduced