Dollar General 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dollar General Corporation 21

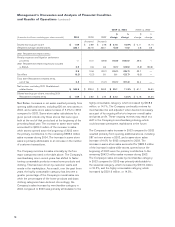

An increase in accrued liabilities resulted in a $45.3

million increase in 2003 cash flows compared to 2002

due in part to the accrued SEC penalty and increased

2003 bonuses described above, increased deferred com-

pensation liabilities and increases in certain tax reserves.

Contributing to the increase in cash flows provided by

operating activities in 2003 was an increase in net

income of $36.7 million driven by the improved operating

results discussed above (see “Results of Operations”).

Cash Flows Used in Investing Activities. Significant

components of the Company’s purchases of property

and equipment in 2004 included the following approxi-

mate amounts: $101 million for distribution and transpor-

tation-related capital expenditures; $82 million for new

stores; $26 million for certain fixtures in existing stores;

$26 million for various systems-related capital projects;

and $23 million for coolers in existing stores, which allow

the stores to carry refrigerated products. During 2004,

the Company opened 722 new stores and relocated or

remodeled 80 stores. Distribution and transportation

expenditures in 2004 included costs associated with the

construction of the Company’s new DC in South Carolina

as well as costs associated with the expansion of the

Ardmore, Oklahoma and South Boston, Virginia DCs.

Net sales of short-term investments in 2004 of $25.8 mil-

lion primarily reflect the Company’s investment activities

in tax-exempt auction market securities.

The Company’s purchases of property and equipment in

2003 included the following approximate amounts: $63

million for new, relocated and remodeled stores; $22 mil-

lion for systems-related capital projects; and $25 million

for distribution and transportation-related capital expendi-

tures. During 2003, the Company opened 673 new

stores and relocated or remodeled 76 stores. Systems-

related projects in 2003 included approximately $6 million

for point-of-sale and satellite technology and $3 million

related to debit/credit/EBT technology. Distribution and

transportation expenditures in 2003 included approxi-

mately $19 million at the Ardmore, Oklahoma and South

Boston, Virginia DCs primarily related to the ongoing

expansion of those facilities.

Net purchases of short-term investments in 2003 of

$67.2 million primarily reflect the Company’s investment

activities in tax-exempt auction market securities.

During 2003, the Company purchased two secured

promissory notes totaling $49.6 million which represent

debt issued by a third party entity from which the

Company leases its DC in South Boston, Virginia.

See Note 8 to the Company’s Consolidated Financial

Statements.

The Company’s purchases of property and equipment

in 2002 included the following approximate amounts:

$51 million for new, relocated and remodeled stores; $30

million for systems-related capital projects; and $21 million

for distribution and transportation-related capital expendi-

tures. The Company opened 622 new stores and relocated

or remodeled 73 stores in 2002. Systems-related capital

projects in 2002 included approximately $15 million for

satellite technology and $3 million for point-of-sale cash

registers. Expenditures for distribution and transportation

consisted in part of $8 million for the purchase of new

trailers and $5 million related to the installation of a dual

sortation system in the Fulton, Missouri DC.

Capital expenditures during 2005 are projected to be

approximately $350 million. The Company anticipates

funding its 2005 capital requirements with cash flows

from operations and the Credit Facility, if necessary.

Significant components of the 2005 capital plan include

the completion of construction of the new DC in South

Carolina and the expected commencement of construction

of the Company’s ninth DC at an as-yet undetermined

location; leasehold improvements and fixtures and equip-

ment for 730 new stores, which includes 30 new Dollar

General Market stores; the continued rollout of the

Company’s EZstore project; and additional investments in

technology and systems. The Company plans to undertake

these expenditures in order to improve its infrastructure

and provide support for its anticipated growth.

Cash Flows Used in Financing Activities. During

2004, the Company repurchased approximately 11.0

million shares of its common stock at a total cost of

$209.3 million and paid cash dividends of $52.7 million,

or $0.16 per share, on its outstanding common stock.

The Company paid cash dividends of $46.9 million, or

$0.14 per share, on its outstanding common stock during

2003. The Company repurchased approximately 1.5 million

shares of its common stock during 2003 at a total cost of

$29.7 million. The Company expended $15.9 million during

2003 to reduce its outstanding capital lease and financing

obligations. These uses of cash were partially offset by