Dollar General 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

Management’s Discussion and Analysis of Financial Condition

and Results of Operations (continued)

increased number of physical inventories and a higher

average cost per physical inventory. Partially offsetting

these increases was a reduction in accruals for employee

bonus expenses (declined 21.3%) primarily related to

higher bonus expense in 2003 related to the Company’s

financial performance during 2003.

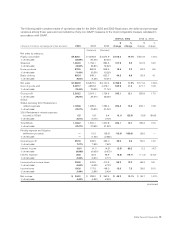

The increase in SG&A expense as a percentage of sales,

excluding expenses relating to the 2001 Restatement

(primarily professional fees), in 2003 as compared with

2002 was due to a number of factors, including but not

limited to increases in the following expense categories

that were in excess of the 12.6 percentage increase in

sales: store labor (increased 14.6%) primarily due to

increases in store training-related costs; the cost of

workers’ compensation and other insurance programs

(increased 29.8%) primarily due to an increase in medical

inflation costs experienced by the Company compared to

previous years; store occupancy costs (increased 16.0%)

primarily due to rising average monthly rentals associated

with the Company’s leased store locations; and higher

bonus expense (increased 34.4%) related to the

Company’s financial performance during 2003.

Penalty Expense and Litigation Settlement

Proceeds. As more fully discussed in Note 8 to the

Consolidated Financial Statements, the Company accrued

$10.0 million in 2003 with respect to a civil penalty

related to its agreement in principle with the Securities

and Exchange Commission (“SEC”) staff to settle the

matters arising out of the Company’s 2001 Restatement.

In 2002, the Company recorded $29.5 million in net

litigation settlement proceeds, which amount included

$29.7 million in insurance proceeds associated with the

settlement of class action and shareholder derivative

litigation, offset by a $0.2 million settlement of a share-

holder class action opt-out claim, all of which related to

the 2001 Restatement.

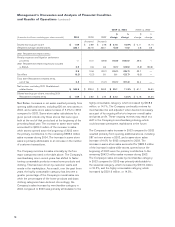

Interest Expense. The decrease in interest expense

in 2004 compared to 2003 is due primarily to capitalized

interest of $3.6 million related to the Company’s DC

construction and expansion projects in 2004 compared

to $0.2 million in 2003 and a reduction in amortization of

debt issuance costs of $2.2 million due in part to the

amendment of the Company’s revolving credit facility in

June 2004. The decrease in interest expense in 2003

as compared to 2002 is due primarily to debt reduction

achieved during 2003. The average daily total debt

outstanding over the past three years was as follows:

2004–$280.1 million at an average interest rate of 8.5%;

2003–$301.5 million at an average interest rate of 8.6%;

and 2002–$575.7 million at an average interest rate of

6.6%. The increase in the Company’s average interest

rate from 2002 to 2003 is due primarily to the reduction

of variable rate debt. All of the Company’s outstanding

indebtedness at January 28, 2005 and January 30, 2004

was fixed rate debt.

Income Taxes. The effective income tax rates for 2004,

2003 and 2002 were 35.6%, 37.3% and 36.1%, respectively.

The 2004 rate was lower than the 2003 rate primarily

due to a net reduction in certain contingent income tax

liabilities of approximately $6.2 million recognized in the

second quarter of 2004, when the Company adjusted its

tax contingency reserve as the result of two state income

tax examinations. The tax rate in 2003 was negatively

impacted by the $10.0 million penalty expense in 2003,

as discussed above, which was not deductible for income

tax purposes. The lower effective tax rate in 2002 was

primarily due to the favorable resolution of certain state

tax related items during 2002.

Liquidity and Capital Resources

Current Financial Condition/Recent

Developments. During the past three years, the

Company has generated an aggregate of approximately

$1.33 billion in cash flows from operating activities.

During that period, the Company has expanded the

number of stores it operates by 32% (1,780 stores) and

has incurred approximately $566 million in capital expen-

ditures, primarily to support this growth. Also during

this three-year period, the Company has reduced its

long-term debt by approximately $464 million and has

expended approximately $239 million for repurchases

of its common stock.

The Company’s inventory balance represented approxi-

mately 48% of its total assets as of January 28, 2005.

The Company’s proficiency in managing its inventory

balances can have a significant impact on the Company’s

cash flows from operations during a given fiscal year.

For example, in 2004, changes in inventory balances

represented a $219.4 million use of cash, as explained

in more detail below, while in 2002, changes in inventory

balances represented an $8.0 million source of cash.

Inventory turns increased from 3.8 times in 2002 to

4.0 times in both 2003 and 2004.