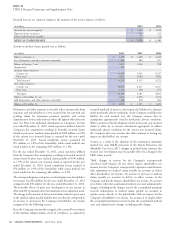

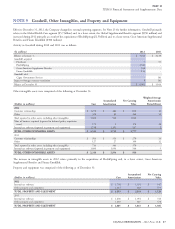

Cigna 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

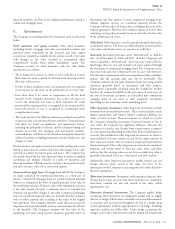

Acquisitions and Dispositions

The Company may from time to time acquire or dispose of assets, allocated to the tangible and intangible net assets acquired based on

subsidiaries or lines of business. Significant transactions are described management’s preliminary estimates of their fair value and may

below. change as additional information becomes available over the next

several months. Accordingly, approximately $117 million was

allocated to identifiable intangible assets, primarily a distribution

A. Joint Venture Agreement with

relationship and the value of business acquired (‘‘VOBA’’) that

Finansbank

represents the present value of the estimated net cash flows from the

long duration contracts in force, with the remaining $113 million

On November 9, 2012, the Company acquired 51% of the total

allocated to goodwill. The identifiable intangible assets will be

shares of Finans Emeklilik ve Hayat A.S. (‘‘Finans Emeklilik’’), a

amortized over an estimated useful life of approximately 10 years.

Turkish insurance company, from Finansbank A.S. (‘‘Finansbank’’), a

Goodwill has been provisionally allocated to the Global Supplemental

Turkish retail bank, for a cash purchase price of approximately

Benefits segment and is not deductible for federal income tax

$116 million. Finansbank continues to hold 49% of the total shares.

purposes.

Finans Emeklilik operates in life insurance, accident insurance and

pension product markets. The acquisition provides Cigna The redeemable noncontrolling interest is classified as temporary

opportunities to reach and serve the growing middle class market in equity in the Company’s Consolidated Balance Sheet because

Turkey through Finansbank’s network of retail banking branches. Finansbank has the right to require the Company to purchase its 49%

In accordance with GAAP, the total purchase price, including the interest in the value of its net assets and the inforce business in

redeemable noncontrolling interest of $111 million, has been 15 years.

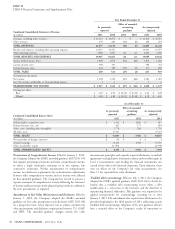

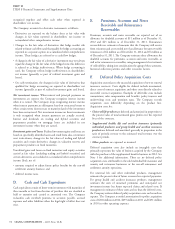

The condensed balance sheet at the acquisition date was as follows:

(In millions)

Investments $23

Cash and cash equivalents 54

Value of business acquired (reported in Deferred policy acquisition costs in the Consolidated Balance Sheet) 28

Goodwill 113

Separate account assets 99

Other assets, including other intangibles 100

Total assets acquired 417

Insurance liabilities 58

Accounts payable, accrued expenses and other liabilities 33

Separate account liabilities 99

Total liabilities acquired 190

Redeemable noncontrolling interest 111

Net assets acquired $ 116

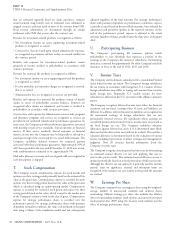

The results of Finans Emeklilik are included in the Company’s In accordance with GAAP, the total purchase price has been allocated

Consolidated Financial Statements from the date of acquisition. The to the tangible and intangible net assets acquired based on

pro forma effects on total revenues and net income assuming the management’s preliminary estimates of their fair value and may

acquisition had occurred as of January 1, 2011 were not material to change as additional information becomes available over the next

the Company for the years ended December 31, 2012 and 2011. several months. The Company updated its allocation of the purchase

price in the fourth quarter of 2012 with the completion of fair

valuation procedures for insurance liabilities and the resolution of

B. Acquisition of Great American

certain tax matters. These changes resulted in an increase in the

Supplemental Benefits Group

allocation to the insurance liabilities by $73 million to $707 million

On August 31, 2012, the Company acquired Great American and to the VOBA asset by $73 million to $144 million. In addition,

Supplemental Benefits Group, one of the largest providers of the allocation to tax accounts was increased by $15 million to a

supplemental health insurance products in the U.S. with cash from $7 million asset. Approximately $168 million was allocated to

internal resources. The Company finalized the purchase price in the intangible assets, primarily the VOBA asset that will be amortized in

first quarter of 2013 that resulted in an increase of $19 million to proportion to premium recognized over the life of the contracts that is

$326 million. The acquisition provides the Company with an estimated to be 30 years. Amortization is expected to be higher in

increased presence in the Medicare supplemental benefits market. It early years and decline as policies lapse. Goodwill has been allocated to

also extends the Company’s global direct-to-consumer retail channel the Global Supplemental Benefits segment as of December 31, 2012.

as well as further enhances its distribution network of agents and Substantially all of the goodwill is tax deductible and will be

brokers. Subsequent to the segment reporting changes in 2012, results amortized over the next 15 years for federal income tax purposes.

of this business are reported in the Global Supplemental Benefits

segment.

CIGNA CORPORATION - 2012 Form 10-K 77

NOTE 3