Cigna 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

There was minimal change in the level of unrecognized tax benefits for certain reinsurance contracts. Trial was held before the United

during 2012. States Tax Court for the 2004 tax year in September 2011. Prior to

trial, the IRS conceded the underlying adjustments but continued to

The December 31, 2012 unrecognized tax benefit balance included challenge the Company’s reserve methodology as a matter of law. The

$29 million that would increase shareholders’ net income if United States Tax Court issued its opinion for the 2004 year on

recognized. The Company has determined it is at least reasonably September 13, 2012. While declining to rule on the broader legal

possible that within the next twelve months there could be a issue, the opinion confirmed the Company’s tax reserve calculation

significant change in the level of unrecognized tax benefits specific to and referenced an IRS representation that it would not challenge the

development in ongoing IRS examinations. These changes are not Company’s reserving methodology in future tax years, thereby

expected to have a material impact on shareholders’ net income. providing certainty that the Company may continue to use its current

reserve methodology prospectively. Tax computations for the 2004 tax

The Company classifies net interest expense on uncertain tax

year have been reviewed by the staff of the Joint Committee of

positions and any applicable penalties as a component of income tax

Taxation and the parties are currently awaiting entry of the Tax

expense, but excludes these amounts from the liability for uncertain

Court’s decision, that is expected shortly. On January 9, 2013 the Tax

tax positions. The Company’s liability for net interest and penalties

Court entered its decision on this issue for the 2005 and 2006 tax

was $3 million at December 31, 2012, $2 million at December 31,

years, ordering and deciding that the Company has no tax deficiency.

2011 and $14 million at December 31, 2010. The 2011 decline

included $11 million associated with the completion of the 2007 and The IRS continues to be engaged in its examination of the Company’s

2008 IRS examinations. 2009 and 2010 consolidated federal income tax returns. This review is

expected to be competed in 2013, and is not expected to have a

During the first quarter of 2011, the IRS completed its examination

material impact on shareholder’s net income. The Company conducts

of the Company’s 2007 and 2008 consolidated federal income tax

business in numerous state and foreign jurisdictions, and may be

returns, resulting in an increase to shareholders’ net income of

engaged in multiple audit proceedings at any given time. Generally,

$24 million ($33 million reported in income tax expense, partially

no further state audit activity is expected for tax years prior to 2008,

offset by a $9 million pre-tax charge). The increase in shareholders’

and prior to 2001 for foreign audit activity.

net income included a reduction in net unrecognized tax benefits of

$11 million and a reduction of interest expense of $11 million The American Taxpayer Act of 2012 was signed into law on January 2,

(reported in income tax expense). 2013. This legislation retroactively extended for 2012, as well as for

2013, several otherwise expired corporate tax provisions from which

the Company benefits. Tax benefits specific to extension of these

D. Federal Income Tax Examinations,

provisions for 2012 will be recorded in the first quarter of 2013, and

Litigation and Other Matters

are not expected to have a material impact on shareholder’s net

income.

The Company has had a continuing dispute with the IRS for tax years

2004 through 2006 regarding the appropriate reserve methodology

Employee Incentive Plans

The People Resources Committee (‘‘the Committee’’) of the Board of As explained further in Note 3, in connection with the HealthSpring

Directors awards stock options, restricted stock, deferred stock and, acquisition on January 31, 2012, HealthSpring employees’ awards of

beginning in 2010, strategic performance shares to certain employees. options and restricted shares of HealthSpring stock were rolled over to

To a very limited extent, the Committee has issued common stock Cigna stock options and restricted stock. Unless otherwise indicated,

instead of cash compensation and dividend equivalent rights as part of information in this footnote includes the effect of the HealthSpring

restricted and deferred stock units. The Company issues shares from rollover awards.

Treasury stock for option exercises, awards of restricted stock and

payment of deferred and restricted stock units.

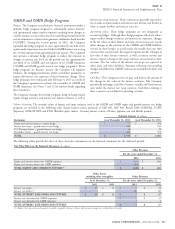

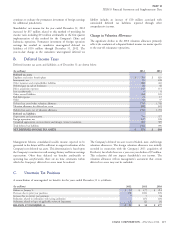

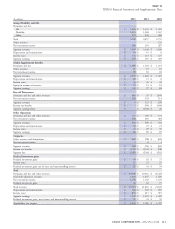

Compensation cost and related tax benefits for these awards were as follows:

(In millions)

2012 2011 2010

Compensation cost $98 $61 $49

Tax benefits $26 $14 $12

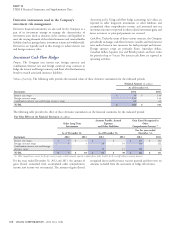

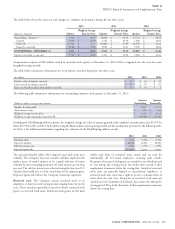

The Company had the following number of shares of common stock grant date. Options vest over periods ranging from one to five years

available for award at December 31: 8.4 million in 2012, 11.7 million and expire no later than 10 years from grant date.

in 2011 and 7.5 million in 2010.

Stock options. The Company awards options to purchase the

Company’s common stock at the market price of the stock on the

116 CIGNA CORPORATION - 2012 Form 10-K

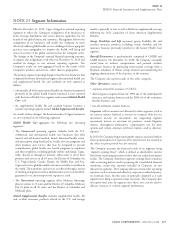

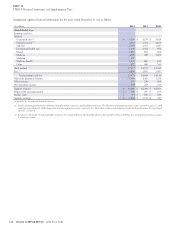

NOTE 21