Cigna 2012 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

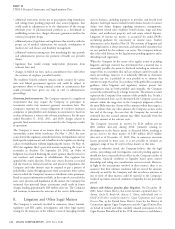

PART II

ITEM 8 Financial Statements and Supplementary Data

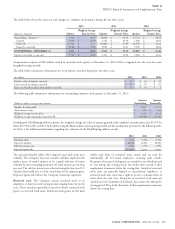

Quarterly Financial Data (unaudited)

The following unaudited quarterly financial data is presented on a consolidated basis for each of the years ended December 31, 2012 and

December 31, 2011. Quarterly financial results necessarily rely heavily on estimates. This and certain other factors, such as the seasonal nature of

portions of the insurance business, suggest the need to exercise caution in drawing specific conclusions from quarterly consolidated results.

Certain reclassifications have been made to previously reported quarterly amounts to conform to the current presentation. See Note 2 to the

Consolidated Financial Statements for additional information.

Three Months Ended

(In millions, except per share amounts)

March 31 June 30 Sept. 30 Dec. 31

Consolidated Results

2012

Total revenues $ 6,754 $ 7,422 $ 7,323 $ 7,620

Income from continuing operations before income taxes 552 588 718 619

Shareholders’ net income 371

(1)

380

(2)

466

(3)

406

(4)

Shareholders’ net income per share: 1

Basic 1.30 1.33 1.64 1.43

Diluted 1.28 1.31 1.61 1.41

2011

Total revenues $ 5,387 $ 5,479 $ 5,574 $ 5,425

Income from continuing operations before income taxes 579 592 273 432

Shareholders’ net income 413

(5)

391

(6)

183

(7)

273

(8)

Shareholders’ net income per share:

Basic 1.53 1.46 0.68 0.99

Diluted 1.51 1.43 0.67 0.98

Stock and Dividend Data

2012

Price range of common stock – high $ 49.89 $ 49.63 $ 47.92 $ 54.53

– low $ 41.27 $ 42.21 $ 39.34 $ 47.31

Dividends declared per common share $ 0.04 $ - $ - $ -

2011

Price range of common stock – high $ 44.29 $ 51.81 $ 52.95 $ 47.61

– low $ 36.76 $ 42.80 $ 40.24 $ 38.82

Dividends declared per common share $ 0.04 $ - $ - $ -

(1) The first quarter of 2012 includes an after-tax gain of $41 million for the GMIB business, an after-tax charge of $28 million for costs associated with acquisitions, and an after-tax charge of

$13 million for costs associated a litigation matter in Global Health Care.

(2) The second quarter of 2012 includes an after-tax loss of $51 million for the GMIB business.

(3) The third quarter of 2012 includes an after-tax gain of $32 million for the GMIB business, an after-tax charge of $12 million for costs associated with acquisitions, and an after-tax charge

of $50 million for costs associated with a realignment and efficiency plan.

(4) The fourth quarter of 2012 includes an after-tax gain of $7 million for the GMIB business and an after-tax charge of $68 million for litigation matters.

(5) The first quarter of 2011 includes an after-tax gain of $13 million for the GMIB business and a net tax benefit of $24 million related to the resolution of a Federal tax matter.

(6) The second quarter of 2011 includes an after-tax loss of $21 million for the GMIB business.

(7) The third quarter of 2011 includes an after-tax loss of $134 million for the GMIB business.

(8) The fourth quarter of 2011 includes an after-tax gain of $7 million for the GMIB business and, an after-tax charge of $31 million for costs associated with acquisitions.

CIGNA CORPORATION - 2012 Form 10-K 127