Cigna 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

ITEM 8 Financial Statements and Supplementary Data

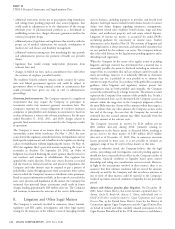

representations or covenants provided by the Company, such as

B. Guaranteed Minimum Income Benefit

representations for the presentation of financial statements, the filing

Contracts

of tax returns, compliance with law or the identification of

outstanding litigation. These obligations are typically subject to

See Notes 11 (fair value) and 13 (derivatives) for further information

various time limitations, defined by the contract or by operation of

on GMIB contracts. Under these guarantees, the future payment

law, such as statutes of limitation. In some cases, the maximum

amounts are dependent on equity and bond fund market and interest

potential amount due is subject to contractual limitations based on a

rate levels prior to and at the date of annuitization election, that must

percentage of the transaction purchase price, while in other cases

occur within 30 days of a policy anniversary, after the appropriate

limitations are not specified or applicable. The Company does not

waiting period. Therefore, the future payments are not fixed and

believe that it is possible to determine the maximum potential amount

determinable under the terms of the contract. Accordingly, the

due under these obligations, since not all amounts due under these

Company’s maximum potential undiscounted future payment of

indemnification obligations are subject to limitation. There were no

$1.1 billion was determined using the following hypothetical

liabilities for these indemnification obligations as of December 31,

assumptions:

2012.

no annuitants surrendered their accounts;

The Company does not expect that these guarantees will have a

all annuitants lived to elect their benefit; material adverse effect on the Company’s consolidated results of

all annuitants elected to receive their benefit on the next available operations, financial condition or liquidity.

date (2013 through 2018); and

all underlying mutual fund investment values remained at the

D. Regulatory and Industry Developments

December 31, 2012 value of $1.1 billion with no future returns.

Employee benefits regulation. The business of administering and

The Company has retrocessional coverage in place from two external

insuring employee benefit programs, particularly health care

reinsurers that covers 55% of the exposures on these contracts. The

programs, is heavily regulated by federal and state laws and

Company reinsured the remainder of the exposures on these contracts

administrative agencies, such as state departments of insurance and

effective February 4, 2013. The Company bears the risk of loss if its

the Federal Departments of Labor and Justice, as well as the courts.

retrocessionaires do not meet or are unable to meet their reinsurance

Regulation, legislation and judicial decisions have resulted in changes

obligations to the Company.

to industry and the Company’s business practices and will continue to

do so in the future. In addition, the Company’s subsidiaries are

C. Certain Other Guarantees

routinely involved with various claims, lawsuits and regulatory and

The Company had indemnification obligations to lenders of up to IRS audits and investigations that could result in financial liability,

$331 million as of December 31, 2012, related to borrowings by changes in business practices, or both.

certain real estate joint ventures that the Company either records as an Health care regulation and legislation in its various forms, including

investment or consolidates. These borrowings, that are nonrecourse to the implementation of the Patient Protection and Affordable Care Act

the Company, are secured by the joint ventures’ real estate properties (including the Reconciliation Act) that was signed into law during the

with fair values in excess of the loan amounts and mature at various first quarter of 2010 and found to be constitutional by the U.S.

dates beginning in 2013 through 2042. The Company’s Supreme Court in June of 2012, could have a material adverse effect

indemnification obligations would require payment to lenders for any on the Company’s health care operations if it inhibits the Company’s

actual damages resulting from certain acts such as unauthorized ability to respond to market demands, adversely affects the way the

ownership transfers, misappropriation of rental payments by others or Company does business, or results in increased medical or

environmental damages. Based on initial and ongoing reviews of administrative costs without improving the quality of care or services.

property management and operations, the Company does not expect Other possible regulatory and legislative changes or judicial decisions

that payments will be required under these indemnification that could have an adverse effect on the Company’s employee benefits

obligations. Any payments that might be required could be recovered businesses include:

through a refinancing or sale of the assets. In some cases, the

Company also has recourse to partners for their proportionate share of additional mandated benefits or services that increase costs;

amounts paid. There were no liabilities required for these legislation that would grant plan participants broader rights to sue

indemnification obligations as of December 31, 2012. their health plans;

As of December 31, 2012, the Company guaranteed that it would changes in public policy and in the political environment, that

compensate the lessors for a shortfall of up to $41 million in the could affect state and federal law, including legislative and

market value of certain leased equipment at the end of the lease. regulatory proposals related to health care issues, that could increase

Guarantees of $16 million expire in 2016 and $25 million expire in cost and affect the market for the Company’s health care products

2025. The Company had liabilities for these guarantees of $2 million and services;

as of December 31, 2012.

changes in Employee Retirement Income Security Act of 1974

The Company had indemnification obligations as of December 31, (‘‘ERISA’’) regulations resulting in increased administrative burdens

2012 in connection with acquisition and disposition transactions. and costs;

These indemnification obligations are triggered by the breach of

CIGNA CORPORATION - 2012 Form 10-K 123

•

•

•

•

•

•

•

•