Cigna 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Remaining Operations

Our remaining operations – including operations in run

o – reported a combined adjusted loss from operations*

of $175 million in 2012. Our early-2013 agreement

with Berkshire Hathaway to effectively exit our run

o reinsurance businesses creates improved financial

flexibility, eliminates volatility and enables us to better

focus on our ongoing health and related businesses.

Continued Success in a Dynamic

Global Business Environment

As we look forward, and assess the transforming economic

and regulatory environment, we see good opportunities for

continued innovation and growth. Demographic shifts and

economic pressures are creating a search for solutions –

especially in the health care sector, where the need to

improve health quality and provide aordable care is

prompting a number of legislative and regulatory activities –

including in the U.S., where health care reform is well

underway. We are well prepared to continue our success

by going deep in our existing markets and selectively

expanding our operations.

As we’ve already seen, the organizations that excel will

be those best equipped to act strategically, nimbly and

with laser focus. Our agility in this environment, in large

part, comes from the degree to which we have successfully

distinguished ourselves as a global health service company,

set apart from traditional health insurance companies.

This transformation began several years ago as we

pioneered the health service model and determined that

our relationships with customers must go deeper than

paying claims. Our thousands of nurses, health coaches,

case managers, health educators and other allied health

professionals form the backbone of a health service

approach that promotes prevention, helps customers

stay well, and understands how to help each customer

on a one-to-one basis – a capability we’ve bolstered

significantly through our acquisition of HealthSpring,

which provides us with a best-in-class physician

engagement model that complements our path to build

collaborative provider relationships.

Our success also comes from the ability to apply the

breadth of our expertise across a diverse global portfolio

of businesses. By orienting ourselves around customer

segments and solutions, rather than geographies, we can

take advantage of our distribution and service delivery

capabilities, more eectively execute our strategy, and

capitalize on market opportunities for the benefit of our

customers and clients. For example, we can now better

serve our global employers and better serve our individual

customers both internationally and in the growing seniors

segment in the United States. In one specific example,

we learned from our U.S. dental operation how to create a

dental product that has become one of the fastest-growing

products in South Korea, to the direct benefit of our

customers in that country.

Cigna’s Critical Differentiators

Cigna has the scale, experience and talent to continue

being successful in developed, developing and emerging

markets as we leverage three critical dierentiators.

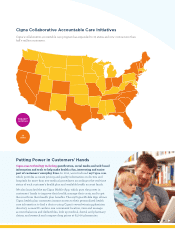

The first is putting our customers at the center of

everything we do, aided by deep analytical insights

that allow us to better understand their needs.

Customer-supporting technologies are a major part

of the integrated, tailored programs we bring to our

customers to empower them to make more informed

health care decisions. More than “apps for the sake

of apps” or technology for the sake of technology,

these programs are at the forefront of the support we

bring, and are serious investments to keep our customers

healthy, which ultimately saves on medical costs.

For example, in 2012, we enhanced myCigna.com to

provide pricing and quality information on doctors

and hospitals for more than 200 medical procedures –

representing 80 percent of customer claims – based on

the customer’s health plan and available health account

funds. We also recently introduced four healthy living

mobile phone applications designed to help our

customers eat right, exercise, get enough sleep and

manage stress.