Cigna 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

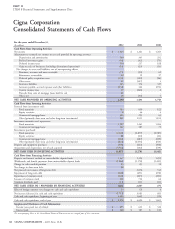

PART II

ITEM 8 Financial Statements and Supplementary Data

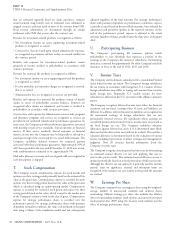

The condensed balance sheet at the acquisition date was as follows:

(In millions)

Investments $ 211

Cash and cash equivalents 36

Reinsurance recoverables 448

Goodwill 168

Value of business acquired (reported in Deferred policy acquisition costs in the Consolidated Balance Sheet) 144

Other assets, including other intangibles 35

Total assets acquired 1,042

Insurance liabilities 707

Accounts payable, accrued expenses and other liabilities 9

Total liabilities acquired 716

Net assets acquired $ 326

The results of this business have been included in the Company’s the District of Columbia, as well as a large, national stand-alone

Consolidated Financial Statements from the date of acquisition. The Medicare prescription drug business. The acquisition of HealthSpring

pro forma effects on total revenues and net income assuming the strengthens the Company’s ability to serve individuals across their life

acquisition had occurred as of January 1, 2011 were not material to stages as well as deepens its presence in a number of geographic

the Company for the years ended December 31, 2012 and 2011. markets. The addition of HealthSpring brings industry leading

physician partnership capabilities and creates the opportunity to

deepen the Company’s existing client and customer relationships, as

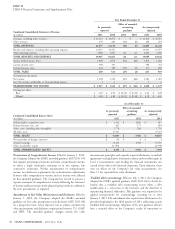

C. Acquisition of HealthSpring, Inc.

well as facilitates a broader deployment of its range of health and

On January 31, 2012 the Company acquired the outstanding shares wellness capabilities and product offerings. The Company funded the

of HealthSpring, Inc. (‘‘HealthSpring’’) for $55 per share in cash and acquisition with internal cash resources.

Cigna stock awards, representing a cost of approximately $3.8 billion.

HealthSpring provides Medicare Advantage coverage in 13 states and

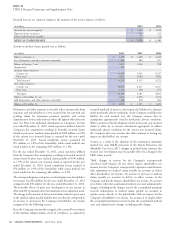

Merger consideration: The estimated merger consideration of $3.8 billion was determined as follows:

(In millions, except per share amounts)

HealthSpring, Inc. common shares outstanding at January 30, 2012 67.8

Less: common shares outstanding not settled in cash (0.1)

Common shares settled in cash 67.7

Price per share $55

Cash consideration for outstanding shares $ 3,725

Fair value of share-based compensation awards 65

Additional cash and equity consideration 21

TOTAL MERGER CONSIDERATION $ 3,811

Fair value of share-based compensation awards. On the date of were generally consistent with those disclosed in Note 21 to the

the acquisition, HealthSpring employees’ awards of options and Company’s 2012 Consolidated Financial Statements, except the

restricted shares of HealthSpring stock were rolled over to Cigna stock expected life assumption of these options ranged from 1.8 to 4.8 years

options and restricted stock. Each holder of a HealthSpring stock and the exercise price did not equal the market value at the grant date.

option or restricted stock award received 1.24 Cigna stock options or Fair value of the new stock options approximated intrinsic value

restricted stock awards. The conversion ratio of 1.24 at the date of because the exercise price at the acquisition date for substantially all of

acquisition was determined by dividing the acquisition price of the options was significantly below Cigna’s stock price.

HealthSpring shares of $55 per share by the price of Cigna stock on The fair value of these options and restricted stock awards was

January 31, 2012 of $44.43. The Cigna stock option exercise price included in the purchase price to the extent that services had been

was determined by using this same conversion ratio. Vesting periods provided prior to the acquisition based on the grant date of the

and the remaining life of the options rolled over with the original original HealthSpring awards and vesting periods. The remaining fair

HealthSpring awards. value not included in the purchase price will be recorded as

The Company valued the share-based compensation awards as of the compensation expense in future periods over the remaining vesting

acquisition date using Cigna’s stock price for restricted stock and a periods. Most of the expense is expected to be recognized in 2012 and

Black-Scholes pricing model for stock options. The assumptions used 2013.

78 CIGNA CORPORATION - 2012 Form 10-K