Cigna 2012 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

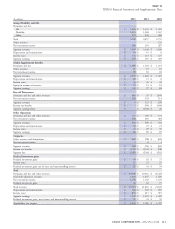

PART II

ITEM 8 Financial Statements and Supplementary Data

formula. The plaintiffs allege various ERISA violations including, 2012. The Company will continue to vigorously defend its position in

among other things, that the Plan’s cash balance formula discriminates this case.

against older employees; the conversion resulted in a wear away period Ingenix. On February 13, 2008, State of New York Attorney General

(when the pre-conversion accrued benefit exceeded the Andrew M. Cuomo announced an industry-wide investigation into

post-conversion benefit); and these conditions are not adequately the use of data provided by Ingenix, Inc., a subsidiary of

disclosed in the Plan. UnitedHealthcare, used to calculate payments for services provided by

In 2008, the court issued a decision finding in favor of Cigna out-of-network providers. The Company received four subpoenas

Corporation and the Cigna Pension Plan on the age discrimination from the New York Attorney General’s office in connection with this

and wear away claims. However, the court found in favor of the investigation and responded appropriately. On February 17, 2009, the

plaintiffs on many aspects of the disclosure claims and ordered an Company entered into an Assurance of Discontinuance resolving the

enhanced level of benefits from the existing cash balance formula for investigation. In connection with the industry-wide resolution, the

the majority of the class, requiring class members to receive their Company contributed $10 million to the establishment of a new

frozen benefits under the pre-conversion Cigna Pension Plan and their non-profit company that now compiles and provides the data

post-1997 accrued benefits under the post-conversion Cigna Pension formerly provided by Ingenix.

Plan. The court also ordered, among other things, pre-judgment and The Company was named as a defendant in a number of putative

post-judgment interest. nationwide class actions asserting that due to the use of data from

Both parties appealed the court’s decisions to the United States Court Ingenix, Inc., the Company improperly underpaid claims, an

of Appeals for the Second Circuit that issued a decision on October 6, industry-wide issue. All of the class actions were consolidated into

2009 affirming the District Court’s judgment and order on all issues. Franco v. Connecticut General Life Insurance Company et al., that is

On January 4, 2010, both parties filed separate petitions for a writ of pending in the United States District Court for the District of New

certiorari to the United States Supreme Court. Cigna’s petition was Jersey. The consolidated amended complaint, filed on August 7, 2009,

granted, and on May 16, 2011, the Supreme Court issued its Opinion asserts claims under ERISA, the RICO statute, the Sherman Antitrust

in which it reversed the lower courts’ decisions and remanded the case Act and New Jersey state law on behalf of subscribers, health care

to the trial judge for reconsideration of the remedy. The Court providers and various medical associations.

unanimously agreed with the Company’s position that the lower On September 23, 2011, the court granted in part and denied in part

courts erred in granting a remedy for an inaccurate plan description the Company’s motion to dismiss the consolidated amended

under an ERISA provision that allows only recovery of plan benefits. complaint. The court dismissed all claims by the health care provider

However, the decision identified possible avenues of ‘‘appropriate and medical association plaintiffs for lack of standing to sue, and as a

equitable relief’’ that plaintiffs may pursue as an alternative remedy. result the case will proceed only on behalf of subscribers. In addition,

The case was returned to the trial court and hearings took place on the court dismissed all of the antitrust claims, the ERISA claims based

December 9, 2011 and March 29-30, 2012. Over the summer, the on disclosure and the New Jersey state law claims. The court did not

trial judge passed away after a long illness and the case was re-assigned. dismiss the ERISA claims for benefits and claims under the RICO

On December 20, 2012, the new trial judge issued a decision statute.

awarding equitable relief to the class. The court’s order requires the Plaintiffs filed a motion to certify a nationwide class of subscriber

Company to reform the pension plan to provide a substantially plaintiffs on December 19, 2011, which was denied on January 16,

identical remedy to that ordered by the first trial judge in 2008. Both 2013. Plaintiffs petitioned for an immediate appeal of the order

parties appealed the order and the judge stayed implementation of the denying class certification, that the Company opposed.

order pending resolution of the appeals. In light of the re-affirmed

It is reasonably possible that others could initiate additional litigation

remedy ordered by the District Court, the Company was required to

or additional regulatory action against the Company with respect to

re-evaluate its reserve for this case. Due to the current economic

use of data provided by Ingenix, Inc. The Company denies the

environment of low interest rates that have a significant impact on the

allegations asserted in the investigations and litigation and will

valuation of potential future pension benefits, the Company was

vigorously defend itself in these matters.

required to increase its reserve for this matter in the fourth quarter of

Subsequent Event – Reinsurance of GMDB and GMIB Business

Effective February 4, 2013, the Company entered into an agreement future claims of approximately $4 billion to be covered by the

with Berkshire Hathaway Life Insurance Company of Nebraska agreement.

(Berkshire) to reinsure the GMDB and GMIB businesses. Berkshire This reinsurance premium will be recorded in the first quarter of 2013

will reinsure 100% of the Company’s future claim payments, net of resulting in an after-tax impact to shareholders’ net income of

retrocessional arrangements in place prior to February 4, 2013, for a approximately $500 million. Premium of $725 million was paid on

reinsurance premium of $2.2 billion. The reinsurance agreement is February 4, 2013 with the remainder to be paid by April 30, 2013.

subject to an overall limit of approximately $3.8 billion plus future This premium will ultimately be funded from the sale or internal

premiums collected under the contracts being reinsured that will be transfer of investment assets that were supporting this book of

paid to Berkshire. The Company estimates that these future premium business, as well as tax benefits related to the transaction, and cash.

amounts will be from $0.1 to $0.3 billion and, accordingly, expects

CIGNA CORPORATION - 2012 Form 10-K 125

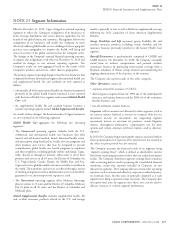

NOTE 25